Introduction

Planning a family vacation can feel exciting—and overwhelming. You want meaningful experiences for everyone, not debt or stress when you return home. The secret isn’t finding a miracle deal; it’s building a realistic plan, sticking to it, and making small, smart choices along the way.

Below is a practical approach you can start today. It blends goal setting, careful cost estimation, strategic saving, and value-driven decisions so you can enjoy the trip without breaking the bank.

Set a clear vacation budget goal

Define must-haves vs nice-to-haves

List three non-negotiables (e.g., a beach day, a theme-park visit, or an accessible hotel with sure-footed kid-friendly rooms).Separate them from nice-to-haves (e.g., a fancy dinner, premium tours).Rank items by value to your family so you know where to spend if you need to cut elsewhere.Pick dates and destinations with cost in mind

Shoulder seasons (early spring, late fall) often bring 20-40% lower costs for flights and lodging.Flexible date ranges can unlock cheaper combinations of flights and hotels.If you’re tied to kids’ school breaks, build in as much flexibility as possible within those windows.Set a hard target and a realistic timeline

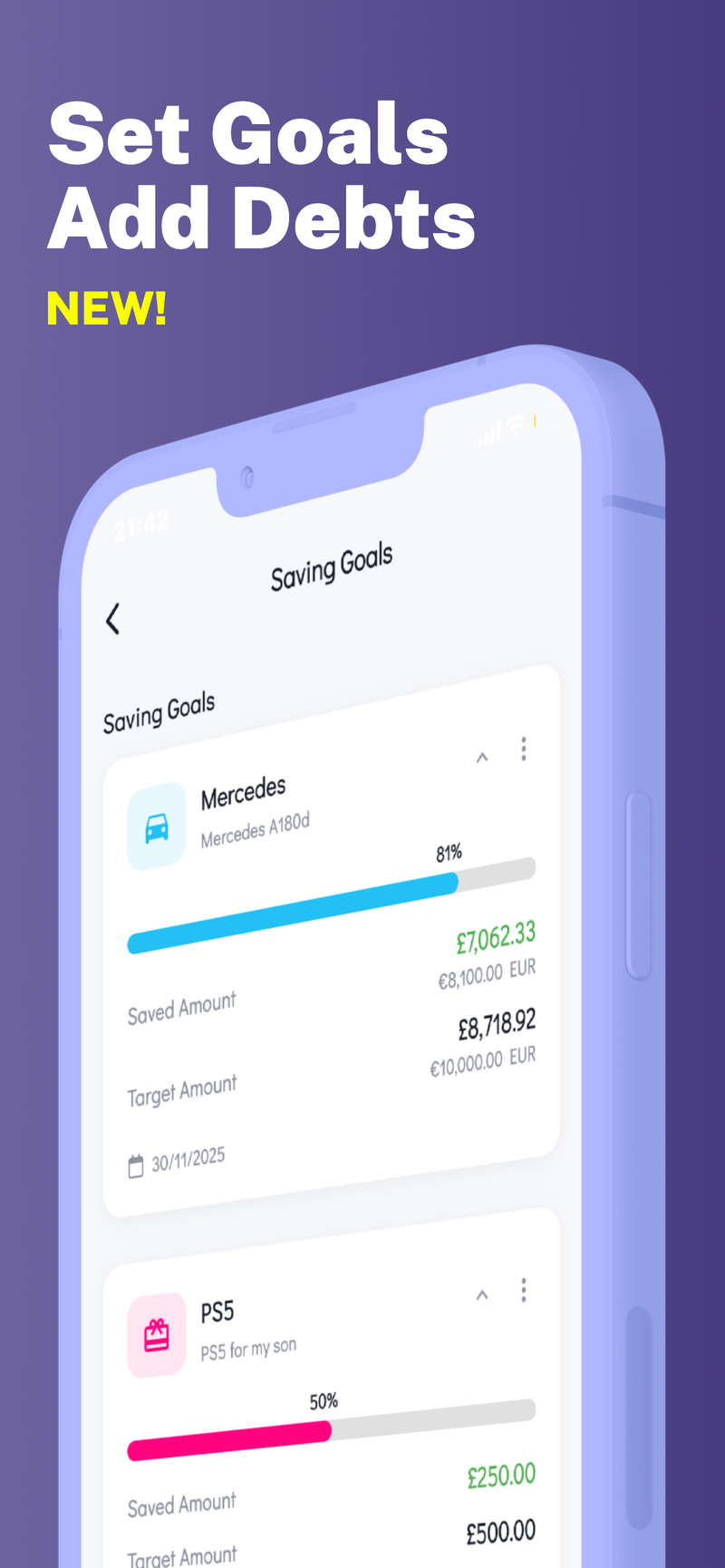

Example: target total trip cost = $3,500. If you have 9 months before departure, aim to save about $390 per month.Add a small buffer (10-15%) for surprises, so your plan doesn’t derail if prices creep up.Break the target into monthly or biweekly transfers to build the habit of saving before spending.Build a realistic cost estimate

Break costs into categories

Travel: airfare, car rental, gas, tolls, or train passes.Lodging: nightly rate times number of nights, plus taxes/fees.Food: groceries for some meals and dining out for others.Activities: tickets, tours, and reservations for must-do experiences.Miscellaneous: souvenirs, transit within the destination, tips, and unexpected costs.Use a simple cost template

Destination and dates: [__________]Nights: [__]Lodging budget per night: [$__]Estimated travel cost: [$__]Food allowance per day per person: [$__]Activities fund: [$__]Misc./buffer: [$__]Total estimate: [$__]Tip: by listing each category, you can see exactly where you can trim without touching your non-negotiables.

Save and pay in advance

Create a dedicated vacation fund

Open a separate savings bucket (or sub-account) so funds aren’t accidentally spent elsewhere.Name it clearly (e.g., “Family Vacation Fund 2025”). Seeing the goal helps motivation.Automate savings and hunt for deals

Set up automatic transfers on payday to accumulate savings gradually.Sign up for price alerts on flights and hotels, and book when prices drop.Use flexible-date search tools to identify cheaper departure windows.Maximize value, not compromise on experience

Choose accommodations strategically

Consider apartment or home rentals for longer stays; cooking some meals saves money and improves variety for kids.Look outside downtown hubs or pick properties with free breakfast or kitchen access.Booking early often yields better rates, but last-minute deals can work if you’re flexible.Focus on free or low-cost activities

Research free museum days, parks, beaches, and community events.Create a “must-do” list with a mix of paid experiences and generous free options to balance the budget.If a paid activity is a family favorite, try to bundle it with a discount or buy in advance.Food strategy that keeps costs reasonable

Plan a few meals in advance and shop for groceries or easy-to-prepare foods.Alternate between quick-service meals and home-cooked options to maintain variety without overspending.Keep a small snack stash for long travel days to avoid impulse buys.Manage the trip and unexpected costs

Build a safety cushion

Set aside 5-10% of the trip budget as a contingency for weather, schedule changes, or cancellations.Have a simple back-up plan for activities or days when plans falter (e.g., indoor alternatives).Track progress and adjust

Review your spending once a week and compare it with your estimates.If you’re ahead, you can upgrade a meal or activity; if you’re behind, switch to cost-saving options for the remainder of the trip.Practical steps you can start this week

1) Create a vacation fund and automate a transfer.2) List must-daves and nice-to-haves for your trip.3) Check shoulder-season dates for your desired destination.4) Build a lightweight cost-template and fill in the numbers.5) Set price alerts and compare lodging options across at least two platforms.

By combining clear goals, disciplined saving, and smart choices about when and where you travel, you can keep your family’s vacation experiences meaningful without overspending.

Conclusion

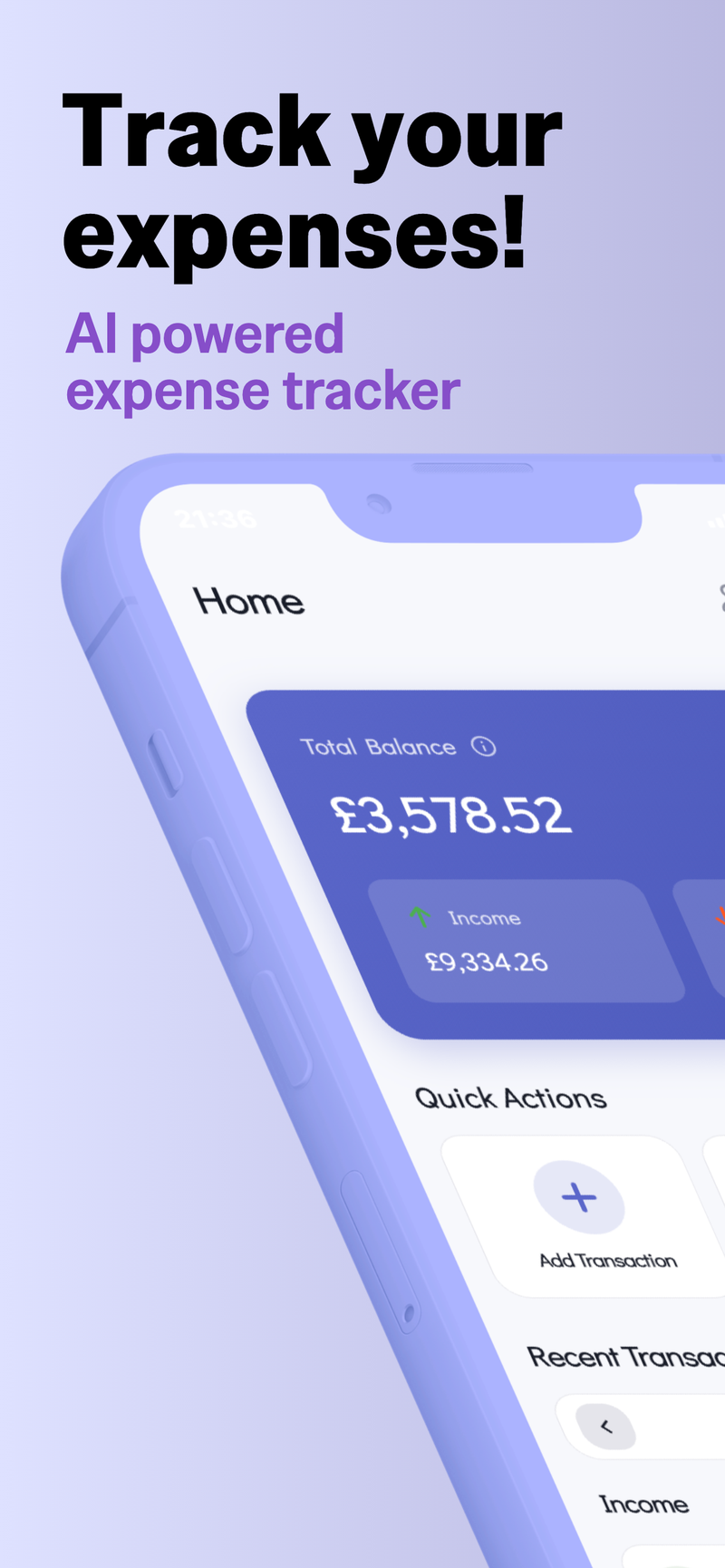

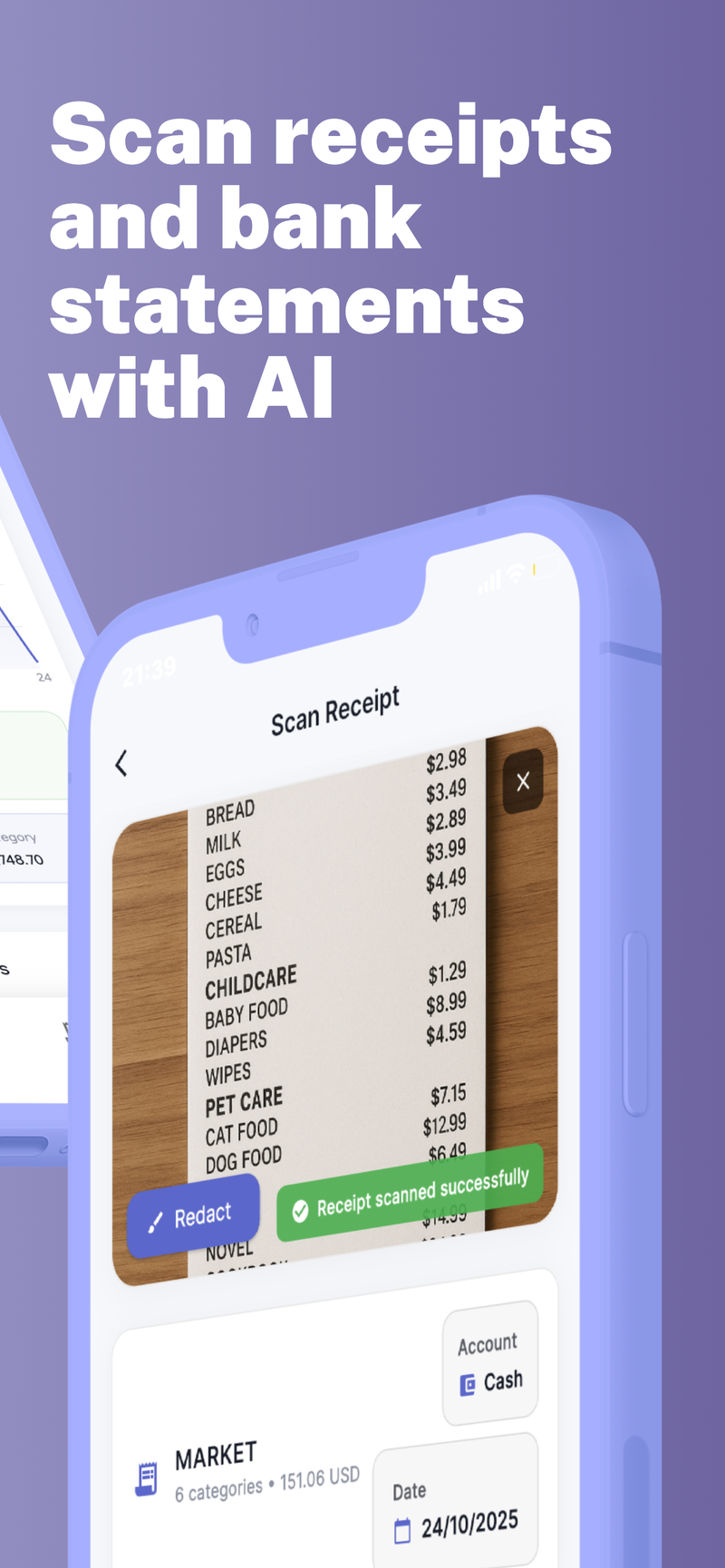

Planning a budget-friendly family vacation is about setting clear goals, estimating costs honestly, and saving consistently before you go. If you’d like a simple, private way to manage multiple family budgets, consider a dedicated personal-finance tool that supports multi-profile tracking and smart budgeting workflows. Fokus Budget can help with this, especially its Multi-Profile Support feature for coordinating different family finances in one place without mixing accounts. It’s a practical companion for planning, spending, and staying on track while you build memories together.