Snowball vs Avalanche: Best Debt Payoff for Families

Introduction

If you’re a parent or caregiver juggling bills, you’ve probably felt the tug between getting quick wins and paying less interest over time. The debt payoff question isn’t just math — it influences motivation, stress, and daily budget choices. Two popular paths are the debt snowball and the debt avalanche. Each has its own psychology and payoff, but the right choice for your family depends on your money flow, goals, and what keeps you moving forward.

Snowball vs Avalanche: Two paths to debt freedom

The Snowball Method

How it works: List all debts from smallest balance to largest, regardless of interest rate. Pay the minimum on every debt except the smallest, to which you add any extra money until it’s paid off. Then move to the next smallest, and so on.Why it helps some families: Quick wins create momentum. You can see debts disappear, which boosts motivation and reduces overwhelm in a tangible way.What to watch for: You may pay more in interest overall if high-rate debts are large. This method emphasizes psychology over total interest savings.The Avalanche Method

How it works: Rank debts by interest rate, from highest to lowest. Pay the minimum on all debts except the highest-rate debt, to which you apply any extra payments until it’s gone. Continue with the next highest rate.Why it helps some families: You minimize interest costs, so you reach debt freedom with less money spent on interest over time.What to watch for: Progress can feel slow when the top-priority debt is large, which might dent motivation if you need visible wins to stay on track.How to choose for your family

Consider your cash flow: If you have irregular income or tight months, the Snowball’s quick wins can help maintain momentum. If you typically manage steady payments, the Avalanche’s savings in interest may be worth the wait.Think about stress and motivation: Do you and your partner need early victories to stay engaged, or are you comfortable with a longer, steadier payoff?Factor in debt mix: If you carry several high-interest cards, Avalanche can cut costs faster. If you have a few small balances, Snowball can deliver faster morale boosts.Practical steps to implement

1) List every debt you owe

Include balance, minimum monthly payment, and APR for each debt. Don’t forget occasional fees or penalties that can creep in.2) Choose your payoff order

Snowball: smallest balance first.Avalanche: highest APR first.If you’re torn, consider a hybrid: start with Snowball for a couple of quick wins, then switch to Avalanche to optimize interest savings.3) Build a realistic budget to free extra cash

Identify nonessential spending you can reduce or pause for a few months (dining out, subscriptions, impulse buys).Aim for an emergency buffer of 1–2 months of essential expenses if you don’t already have one.Decide how much extra you can consistently apply toward debt each month (a fixed amount, plus any windfalls).4) Create a payoff calendar

Set a target payoff date for the first debt, then update after each payoff.Visualize progress with a simple chart or checklist to celebrate milestones.5) Use windfalls wisely

Apply any tax refunds, bonuses, or gifts toward the top of your payoff list.Avoid diverting windfalls to new discretionary spending.6) Reassess every 3 months

If your income changes or expenses spike, adjust the extra payment amount and revisit the payoff order.Real-world tips to stay on track

Automate payments and reminders: Automated, on-time payments reduce penalties and keep your plan intact.Negotiate interest rates or transfer balances: Call creditors to ask for lower rates or explore balance-transfer options with minimal fees.Build a small cushion: A modest emergency fund prevents new debt if an unexpected expense arises.Use a simple calculator: A debt payoff calculator can show how long it takes with different extra payment amounts and orders.Communicate openly: Regular family check-ins on progress prevent misunderstandings and keep everyone aligned with the plan.Common pitfalls and when to pivot

Overreaching on a tight budget: If the monthly plan feels unsustainable, scale back the extra payment slightly and extend the payoff timeline—consistency matters more than speed.Ignoring new debt: Any new debt should be evaluated against your current plan. If it’s high-interest, consider treating it as a priority debt.Not revisiting the plan: Life changes (income, expenses, goals) require adjustments. A stagnant plan loses effectiveness.Quick-start checklist

[ ] List all debts with balances, minimum payments, and APRs[ ] Pick Snowball or Avalanche (or a hybrid) based on your situation[ ] Set a realistic extra monthly payment amount[ ] Create a payoff calendar and track progress weekly[ ] Build a small emergency fund and automate payments[ ] Reassess every 3 monthsConclusion

Choosing between debt snowball and debt avalanche isn’t about which method is “best” in theory—it's about which approach keeps your family motivated, financially disciplined, and moving toward fewer bills each month. You can tailor the strategy to your income, expenses, and stress level, then adjust as life changes. Consistency, not perfection, beats aggressive starts that fizzle out.

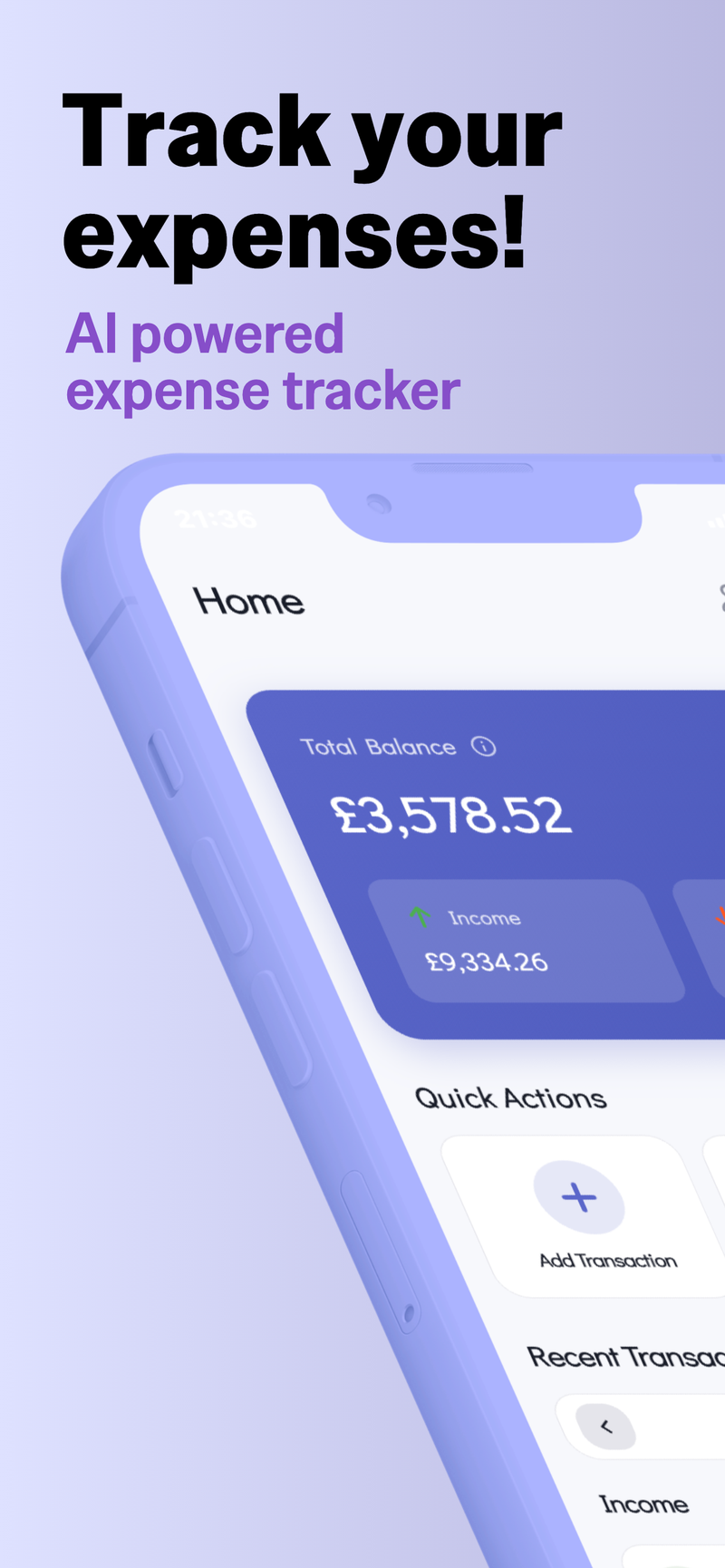

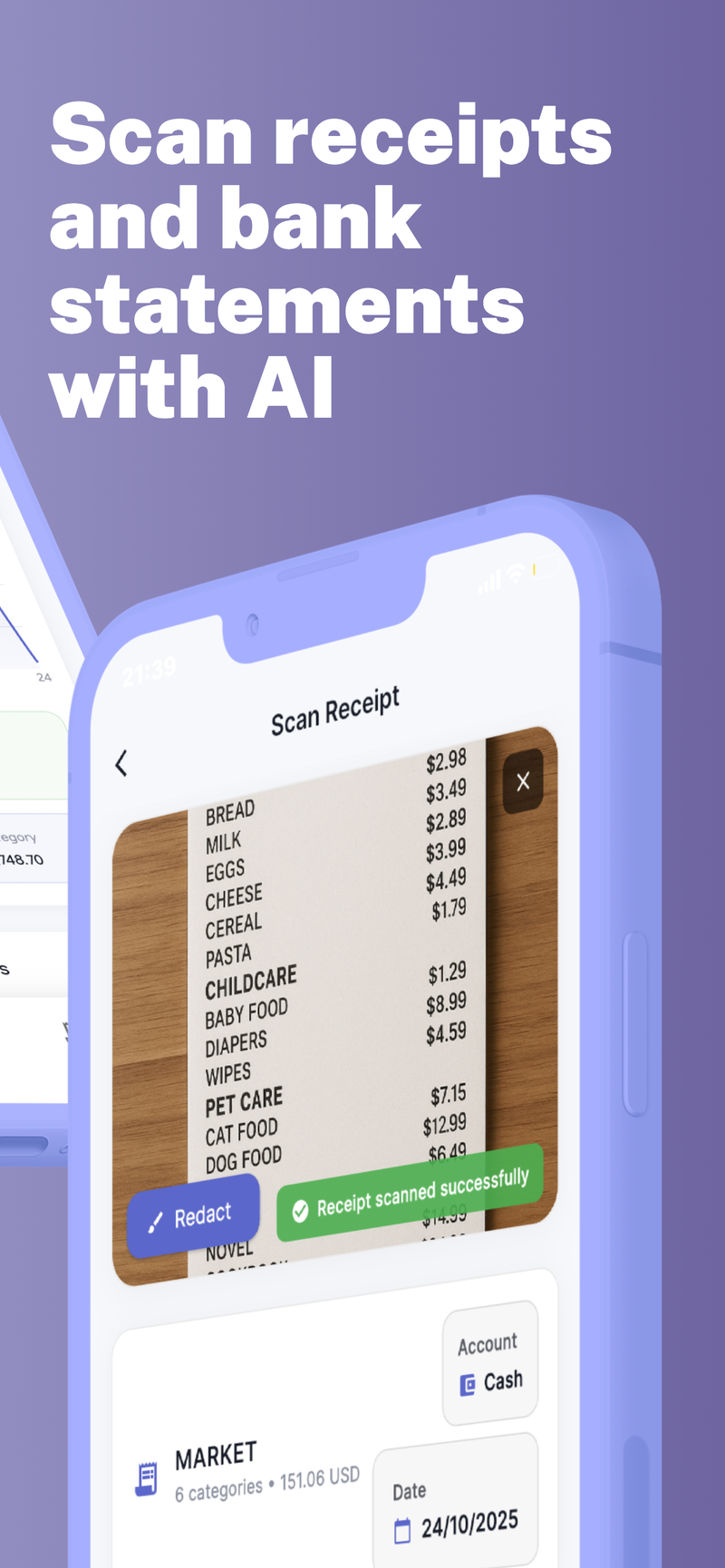

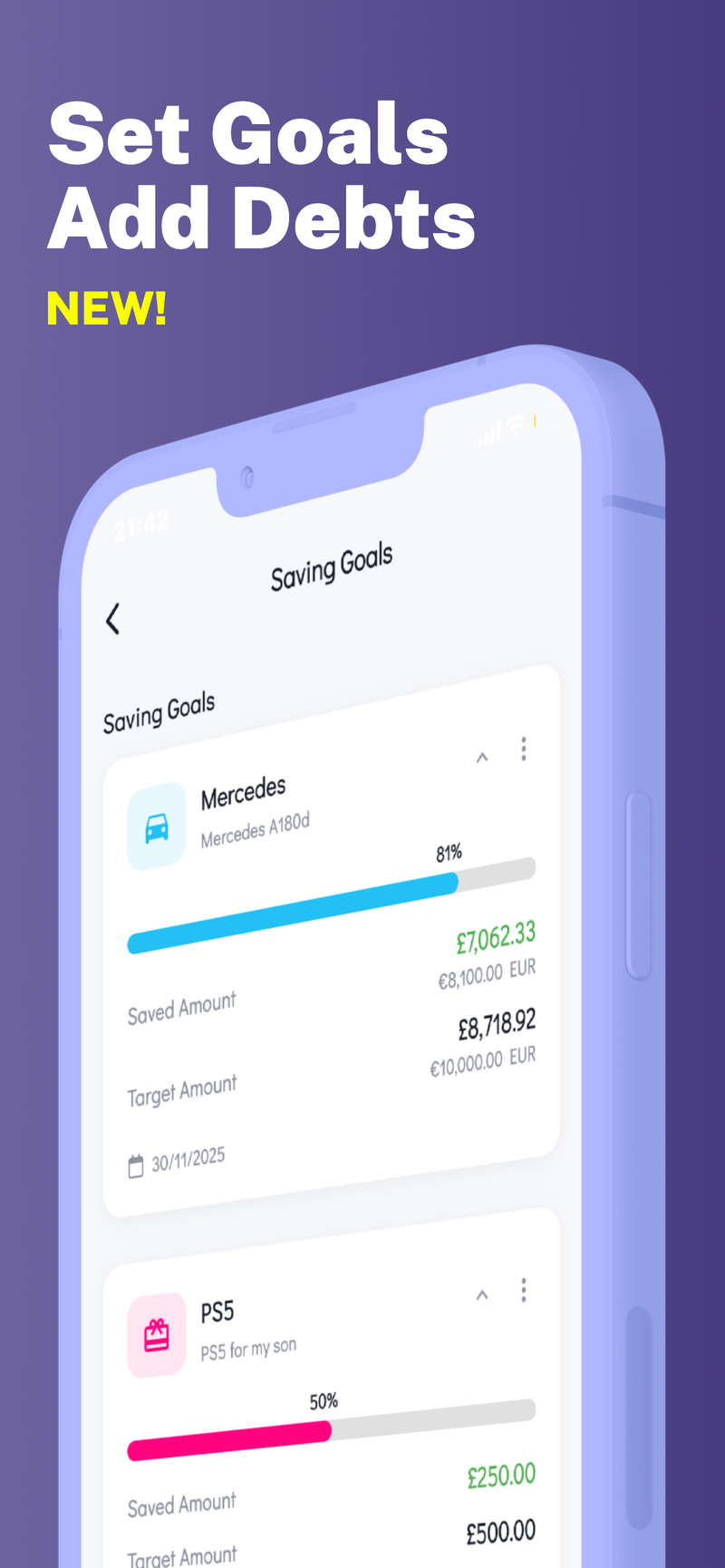

If you’re looking for a practical way to apply this at home, a private budgeting tool that helps you track multiple family profiles, manage cash flow, and keep your data secure can make a big difference. Fokus Budget offers features like Multi-Profile Support to help families organize budgets for up to five profiles, while keeping your information on your device for privacy. It’s a subtle, supportive aid—meant to help you stay organized as you work toward debt freedom.