Smart Ways to Cut Household Costs Without Cutting Essentials

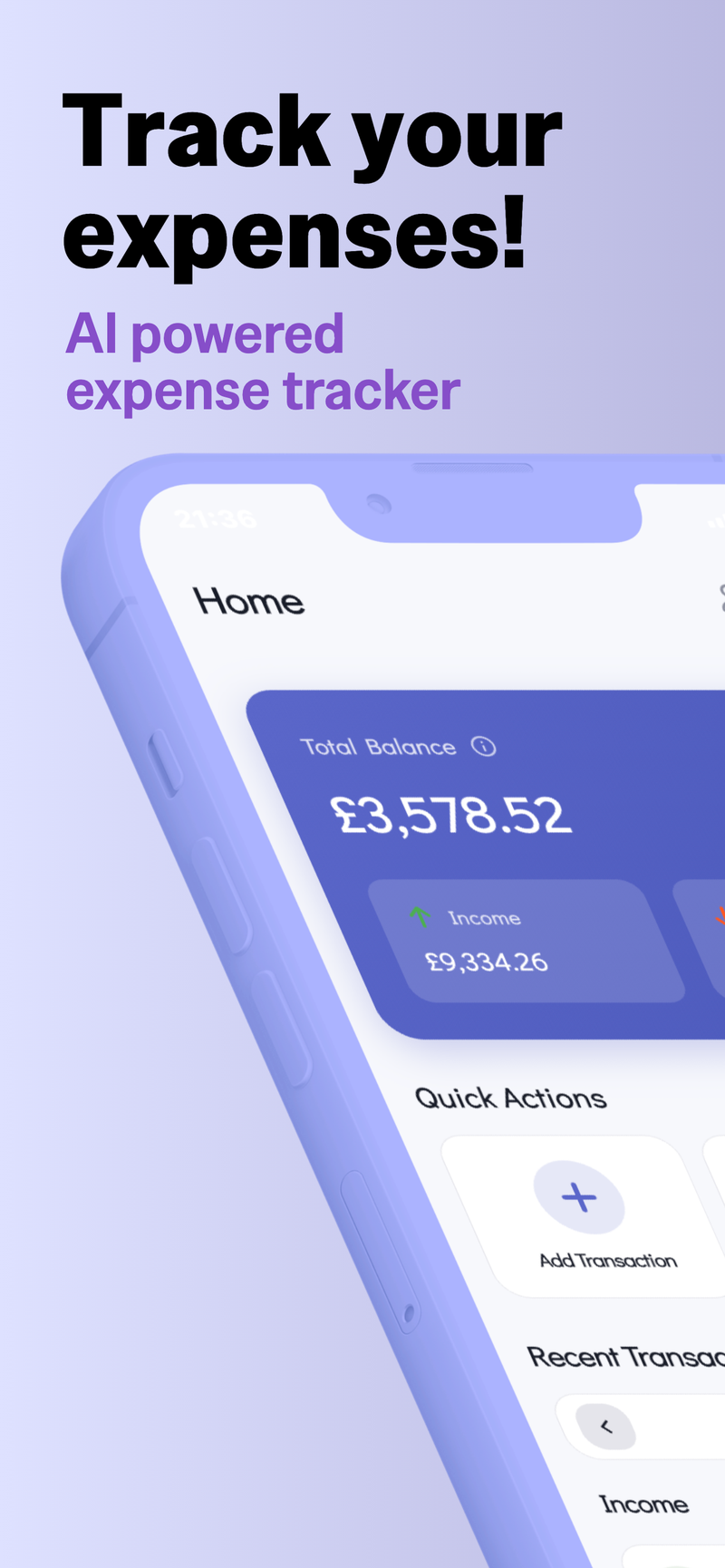

Small, steady changes can dramatically reduce household costs without sacrificing essentials. This guide offers practical steps—audit spending, plan meals, save energy, and prune recurring charges—to build a smarter budget. A private, budget-focused tool can support this journey.

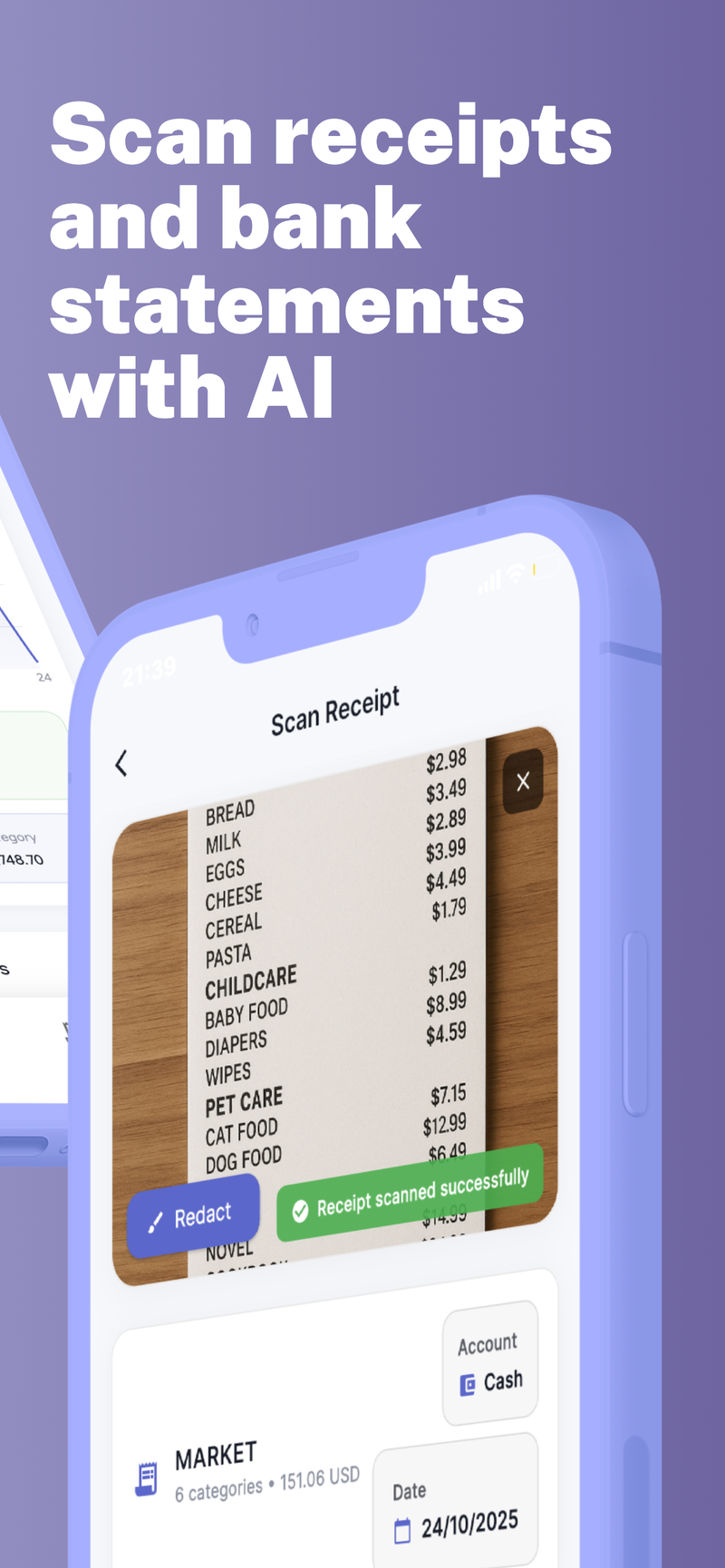

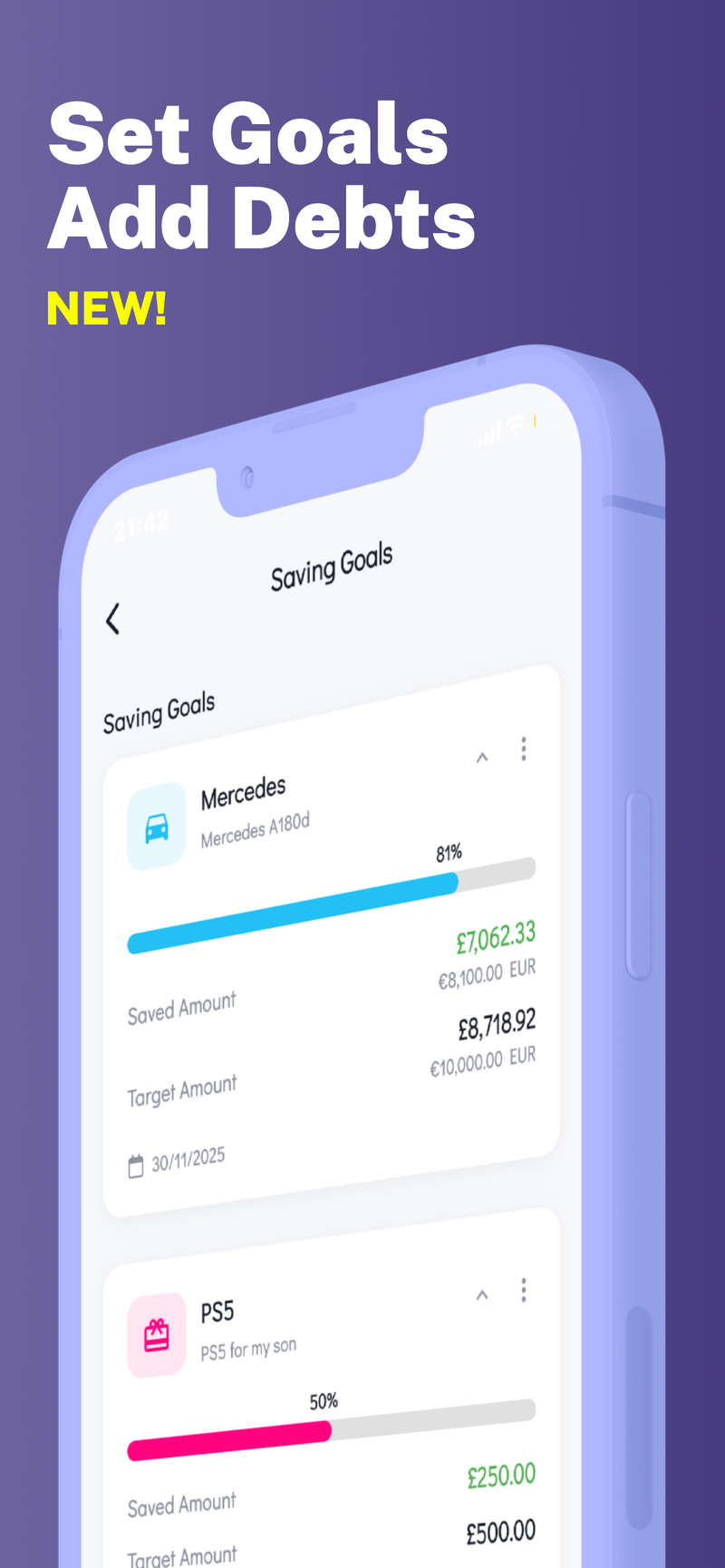

Introduction Are you surprised every month when the bills arrive, and your paycheck seems to shrink? You’re not alone. Even when you’re scrupulous about essentials like rent, utilities, and groceries, costs creep up—sometimes in small, invisible ways. The good news is you don’t have to live on ramen-and-rent-level austerity to regain control. A few targeted shifts, tracked consistently, can add up to meaningful savings without erasing what you really need. ## Smart, practical approaches to cut costs without sacrificing essentials ### 1) Start with a spending audit A clear picture beats guesswork. Start by tracking your spending for a full month and separating fixed costs (rent, loan payments) from variable ones (groceries, dining out). - Gather the last 1–2 months of statements and receipts. - Create three buckets: needs, wants, and savings/debt repayment. - Identify “money leaks” such as small recurring purchases you barely notice. - Challenge each category: can you reduce, defer, or replace any item with a cheaper alternative? - Set a simple target, like a 5–15% reduction in discretionary spending, and review weekly. A zero-based budget approach—where every dollar is assigned a job—helps you stay intentional rather than reactive. ### 2) Grocery budgeting and meal planning Grocery bills tend to rise with impulse purchases and unplanned meals. A steady meal plan cuts waste and saves money. - Plan weekly meals around what you already have in the pantry and what’s on sale. - Build a precise shopping list from the plan and stick to it. Avoid shopping hungry or while scrolling social feeds that tempt impulse buys. - Compare unit prices, not just sticker prices. Buy seasonal produce and bulk items when they truly save money. - Batch-cook and portion meals for the week; use leftovers creatively to avoid waste. - Reserve a dedicated “leftovers night” to clear the fridge and minimize spoilage. - Typical results: meal planning can reduce grocery costs by about 10–20% for many households. Note: a well-organized kitchen reduces waste—and waste is expensive. A little planning goes a long way. ### 3) Energy and utilities: small changes, big gains Energy costs are a predictable drain if left unchecked. Small adjustments often yield noticeable savings. - Lower the thermostat by 1–2°C in winter and wear warmer clothing indoors; in summer, use fans or shades to reduce AC use. - Use a programmable thermostat to tailor heating and cooling to your schedule. - Seal drafts, insulate exposed pipes, and weather-strip doors and windows. - Switch to LED bulbs and unplug idle electronics; appliances still draw standby power even when off. - Run full loads for laundry and dishes; consider cold-water cycles where feasible. - Inspect water fixtures for leaks; fixing a single leak can save gallons per day. - If available, compare energy providers or rate plans to ensure you’re paying a fair price. - Big idea: heating and cooling can account for a large portion of energy usage, so even modest efficiency gains compound over the year. ### 4) Transportation and car costs Transportation often eats a sizable slice of the budget, even for those who aren’t daily commuters. - Carpool, public transit, biking, or walking whenever possible. - Combine errands to reduce trips and save fuel. - Maintain tires at the proper pressure and service your vehicle on schedule to improve fuel economy. - Review insurance options and deductibles; ask about multi-policy discounts. - Plan a monthly fuel budget and track deviations to catch inefficiencies early. - If you’re considering a big purchase, compare total ownership costs (fuel, maintenance, insurance) rather than just sticker price. ### 5) Subscriptions, memberships, and recurring charges It’s easy to lose track of small monthly charges until they add up. - List every active subscription and their renewal dates. - Cancel any you don’t actively use or need. - Downgrade plans rather than canceling completely when possible (e.g., streaming tier, software licenses). - Share services with family or roommates where allowed to split costs. - Set a monthly “subscription review” date to re-evaluate value and usage. ### 6) Housing, insurance, and debt costs Housing remains a core necessity, but there are smart ways to reduce strain without compromising safety or comfort. - If you rent, consider negotiating at lease renewal about minor upgrades, a small rent bump in exchange for improvements, or extending the term for a lower rate. - For homeowners, shop around for homeowners insurance or bundle with auto to save; check if your deductible can be adjusted to lower monthly costs. - Review debt payments: could refinancing or more aggressive debt snowball/avalanche strategies reduce total interest over time? - Perform a yearly maintenance checklist to prevent costly repairs later; small, proactive fixes pay off. ### 7) DIY and maintenance Building a few practical skills can prevent expensive service calls and replacements. - Learn basic repairs (caulking windows, unclogging drains, replacing a faulty socket) and handle simple tasks yourself when safe. - Replace worn-out tools only as needed; reuse and repurpose items when feasible. - Use thrifted or second-hand items for non-critical needs; repair rather than replace where possible. ### 8) A simple, actionable plan to start today - Week 1: Complete your spending audit; identify two big leaks to fix. - Week 2: Create a weekly meal plan and strict shopping list; track grocery savings. - Week 3: Implement energy-saving tweaks and review utility bills. - Week 4: Audit subscriptions and housing-related costs; set a plan for ongoing maintenance. By breaking the process into small, measurable steps, you’ll avoid overwhelm and see progress quickly. ## Conclusion Cutting costs without sacrificing essentials is less about deprivation and more about intentional choices and steady tracking. Start with a quick audit, make a weekly plan, and tackle energy, grocer

✨ Privacy-first on-device data storage