Debug Your Budget: Find Hidden Spending in 4 Steps

Feeling like your budget has blind spots? This guide reveals four practical steps to uncover hidden spending, trim waste, and take control of your finances with real, actionable tips.

Introduction

Do you feel like your budget has blind spots? You may track groceries and bills, but subtle charges slip through: monthly subscriptions you forgot you signed up for, impulse buys from online carts, or recurring fees that seem tiny day by day but add up fast. You’re not alone. Many households discover that roughly five to fifteen percent of monthly spending hides in plain sight. The good news: hidden spending is solvable with a simple, repeatable process. In four steps you can reveal leaks, curb waste, and redirect money toward what matters most.

Main Content

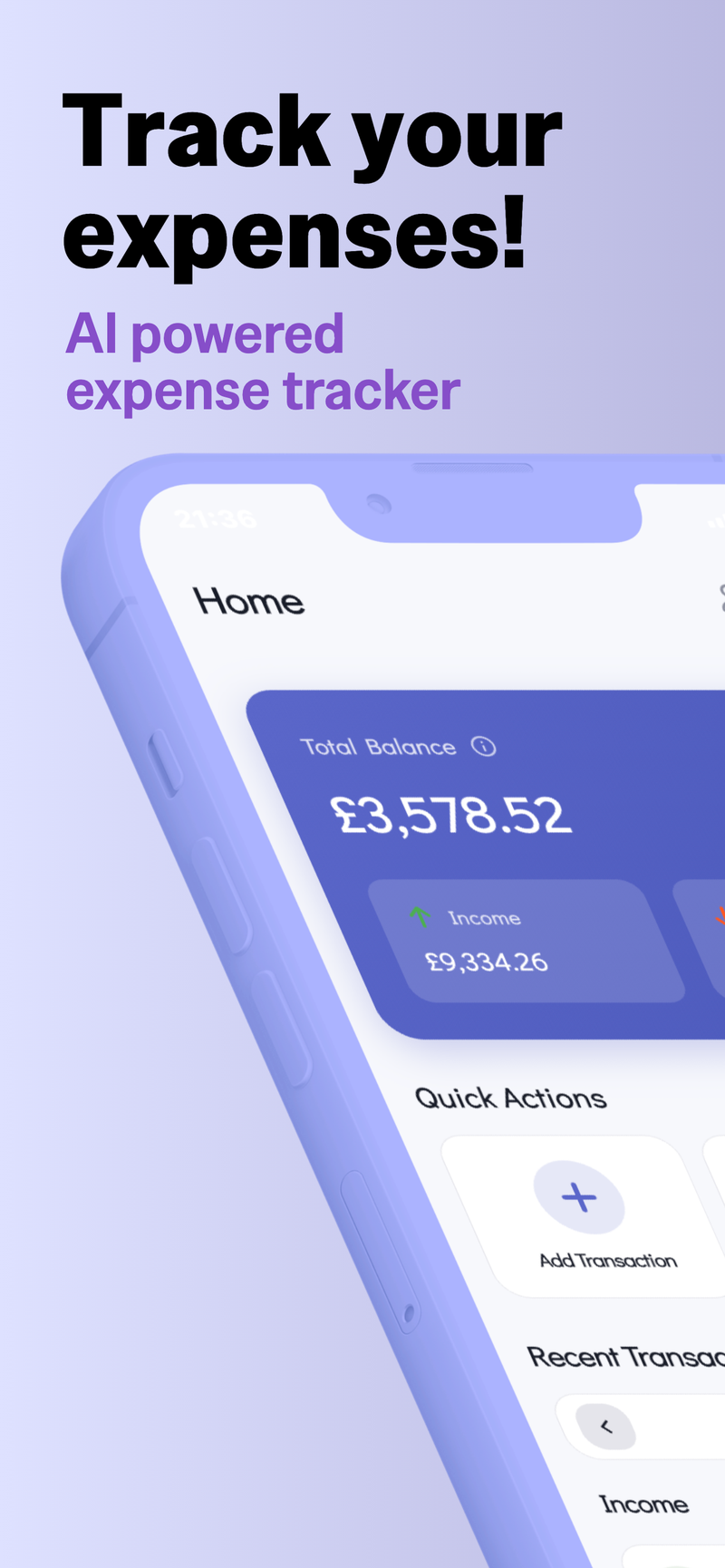

Step 1: Track every dollar for 30 days

Start with a clear, 30-day window. Use a method you’ll actually stick with—paper ledger, spreadsheet, or a basic expense tracker—and record every dollar you spend. Tips:

Real-world example: a family notices $8 coffee purchases every weekday in a month-long log. That pattern alone can shift from a small daily indulgence to a meaningful annual savings if redirected or reduced.

A practical outcome of this step is awareness. You’ll know where the money actually flows, not just where you think it goes.

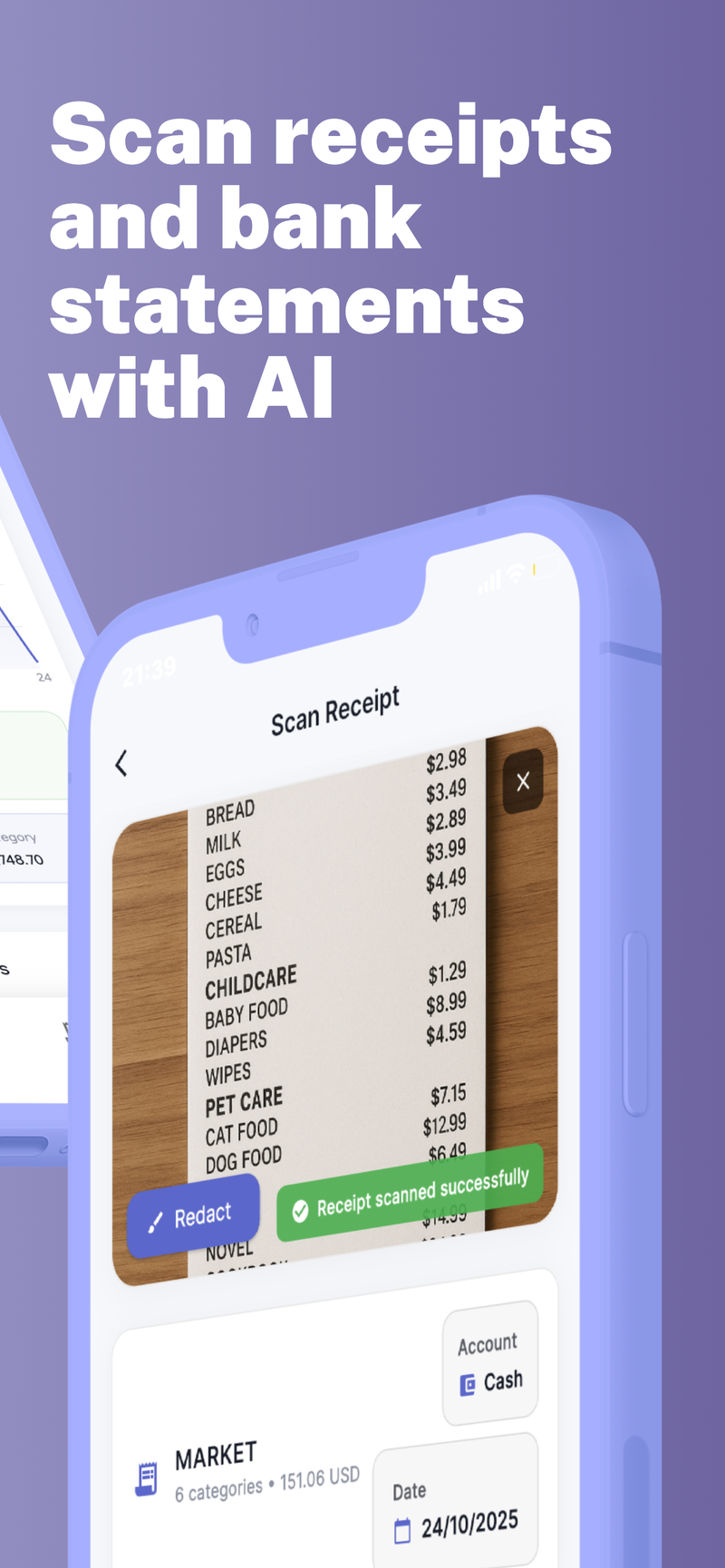

Step 2: Uncover recurring leaks (subscriptions and automatic charges)

Recurring payments are the sneakiest leaks because they occur without daily action. Your task:

Insight: recurring charges often represent a sizable chunk of monthly spending. By auditing them, you can cancel or consolidate and regain control with minimal effort.

Practical tip: set renewal reminders 7–14 days before the charge date and revisit each item quarterly. If it doesn’t deliver enough value, it’s a candidate for removal.

Step 3: Scrutinize everyday spending (the impulse zone)

Everyday purchases—coffee runs, impulse buys, quick trips to the store—are where many budgets quietly deteriorate. Approach:

Small habits have big impact. For example, a daily coffee at $4 becomes $120 per month; choosing home-brewed coffee at $0.50 changes that to a savings of roughly $100+ per month. If you’re shopping for groceries, compare bulk versus single-serve options and resist convenience buys that don’t move your goals forward.

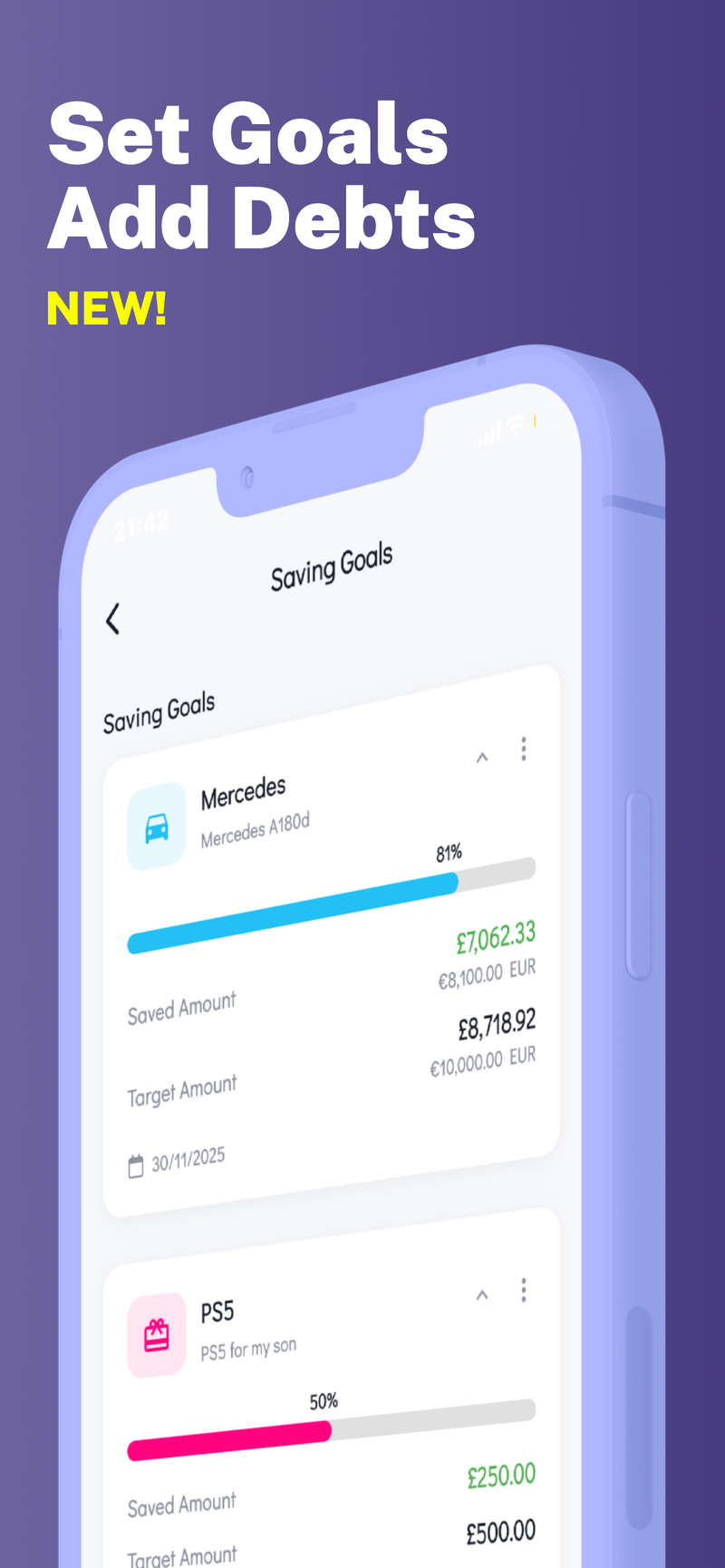

Step 4: Build a plan that sticks

The most important step is turning awareness into action. Construct a plan that’s realistic and durable:

A practical template: Needs stay as they are; Wants get a defined cap; Wastes are eliminated or dramatically reduced. If you can consistently meet the step-by-step targets, you’ll see a tangible shift in your overall balance within a couple of months.

Conclusion

Hidden spending isn’t about guilt or deprivation—it’s about visibility and control. By tracking for a full month, auditing recurring charges, scrutinizing everyday purchases, and building a plan with built-in friction, you can reclaim dollars and direct them toward what truly matters.

If you’d like a privacy-first way to manage similar steps at scale, consider a budgeting solution that keeps data on your device while supporting multiple profiles. For families and individuals juggling different budgets, features like Multi-Profile Support can be especially helpful, letting you track personal, family, and even business budgets in one place without mixing sensitive data.

A small, deliberate four-step routine can transform your finances over weeks, not months.

✨ Multi-Profile Support