Introduction

Bills move with the calendar: seasonal costs, price hikes, and unexpected charges can throw a wrench into even the best-laid plans. When bills change, a rigid budget quickly feels off course. The good news is you can build a plan that adapts without chaos. By focusing on clarity, buffers, and quick adjustment rules, you’ll stay on track even when costs swing. For context, the Federal Reserve notes that roughly a quarter of U.S. households would struggle to cover a $400 emergency — a reminder that flexibility isn’t optional, it’s essential.

A practical 4-week plan for when bills change

This plan is designed to be doable, not perfect. It focuses on actionable steps you can implement week by week, with simple formulas and clear signals for when to adjust.

Week 1 — Capture, categorize, and set a baseline

Gather statements from the last 90 days to identify every recurring charge and the true cost of essentials (housing, utilities, groceries, transport, insurance, minimum debt payments).Categorize each expense into: Fixed Essentials, Flexible Essentials, and Wants.Create a baseline budget for a typical month using those categories. Start with a simple framework like: Needs (Fixed + Flexible Essentials) 60–70%, Wants 10–20%, Savings/Debt 10–20%. Adjust to fit your income, but aim to cover essentials first.Define a minimum viable monthly spend (MVMS) — the smallest amount you need to keep a roof over your head, food on the table, and essential transport — and a comfort buffer for the unexpected.Set a weekly check-in: spend versus plan and note any deviations from the baseline.Week 2 — Build flexibility and buffers

Build a clear adjustment rule: if a major bill increases, trim discretionary spending first (e.g., dining out, entertainment, nonessential subscriptions) rather than dipping into essentials.Create a short-term buffer. If you can’t fully cover the MVMS in a month, aim for a 0.5x to 1x of essential costs as a small cushion over the next 1–2 months.Separate your plan into two targets: current-month needs and a rolling buffer for irregular months. Use a two-column approach: Needs + Buffer, and Wants. Rebalance weekly as bills come in.Identify quick savings opportunities (energy use, grocery substitutions, cheaper phone plan, canceling unused subscriptions) and earmark those gains to the buffer.Practice a 5-minute weekly review: update the next 4 weeks, adjust for any mid-month changes, and confirm due dates align with paydays.Week 3 — Implement and prioritize

Align bill due dates with your paycheck schedule when possible. If a due date falls after a low-cash week, request a date change or adjust autopay timing.Set up a small, automatic replenishment to the buffer when you have a surplus (e.g., pay raises, windfalls, or lower bills). Even a modest weekly contribution helps.Build quick-cost-cutting playbooks for common shocks:If utilities spike: drop nonessential thermostat changes, check for energy-saving settings, switch to a cheaper plan if available.If groceries rise: switch to generic brands, plan meals around sale items, batch-cook and freeze.Do scenario planning: outline three simple forecasts — best case (bills stay the same), moderate shift (bills up 5–10%), and sizable shift (bills up 15–20% with at least one month of irregular expense).Create a short list of negotiable costs (subscriptions, services, memberships) that you can trim in response to a change in bills.Week 4 — Review and prepare for next month

Reconcile your actual spending against the plan. Identify where you consistently overshot and where you consistently saved.Update your forecast for the next month using your three scenarios. Keep the most likely scenario as your default plan, with a ready-to-activate adjustment if the reality shifts.Establish trigger points: if a bill goes above a defined threshold, switch X discretionary area to Y, or add Z to the buffer.Create a simple monthly checklist you can repeat, including: verify due dates, confirm automatic payments, review subscriptions, and adjust as needed.Celebrate progress and note what worked. Small wins compound: consistent tracking, timely adjustments, and clearer priorities.Practical tips and notes

Always start with needs. A solid baseline of essentials protects you from spiraling debt when bills change.Use a rolling average for variable bills (utilities, groceries) to smooth volatility. If a month is unusually high, offset with planned reductions elsewhere over the next month.Don’t chase perfection. Even a modest, repeatable process reduces stress and improves outcomes over time.Keep a single, simple record of where your money goes. A clear overview makes adjustments faster and debt payoff more achievable.Consider automating payments and reminders to improve on-time payments, which helps avoid late fees and penalties.Conclusion

A four-week plan can transform how you handle fluctuating bills from a source of stress into a repeatable process. The key is capturing the data, building sensible buffers, and creating clear adjustment rules you actually follow. When you can forecast changes and respond quickly, you protect your essentials, preserve your goals, and keep financial momentum—even in months when bills surprise you.

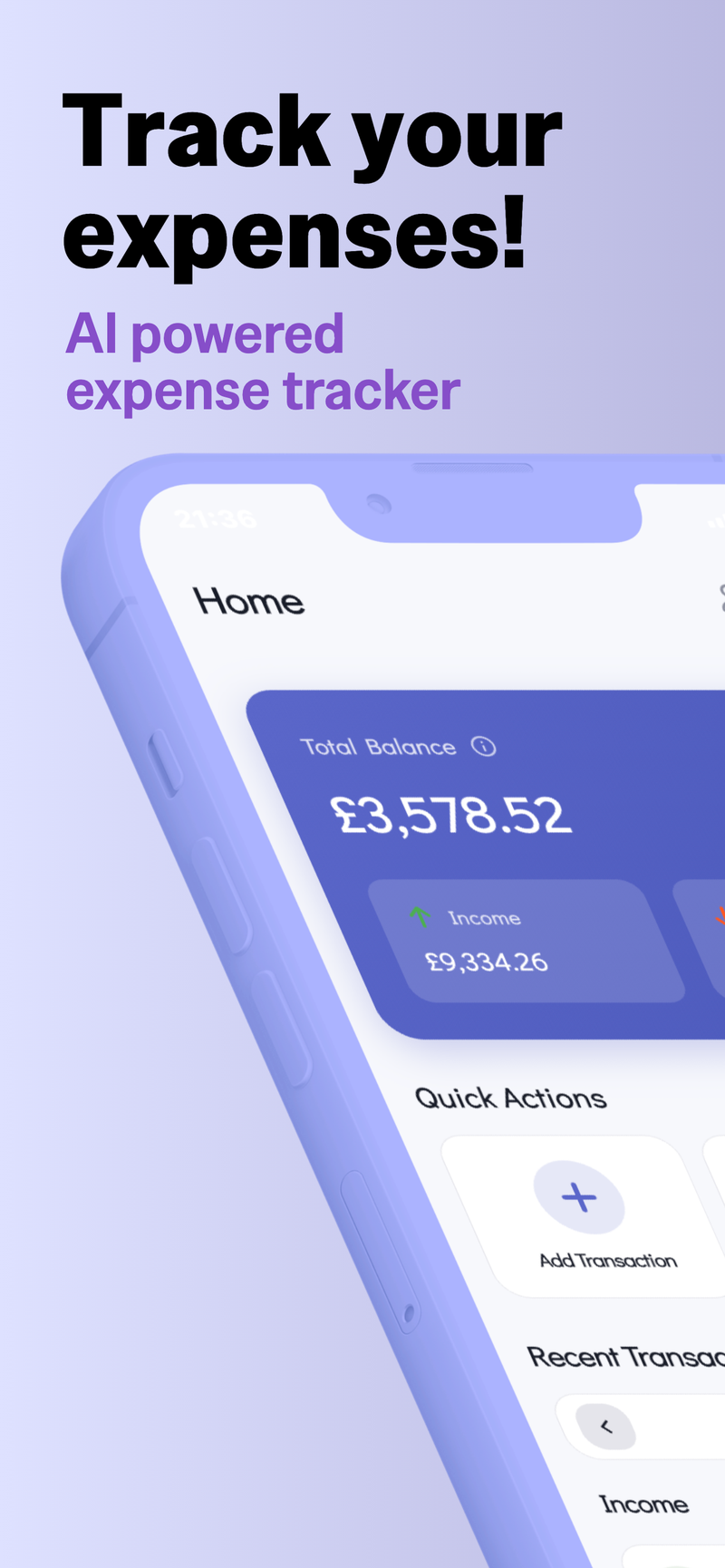

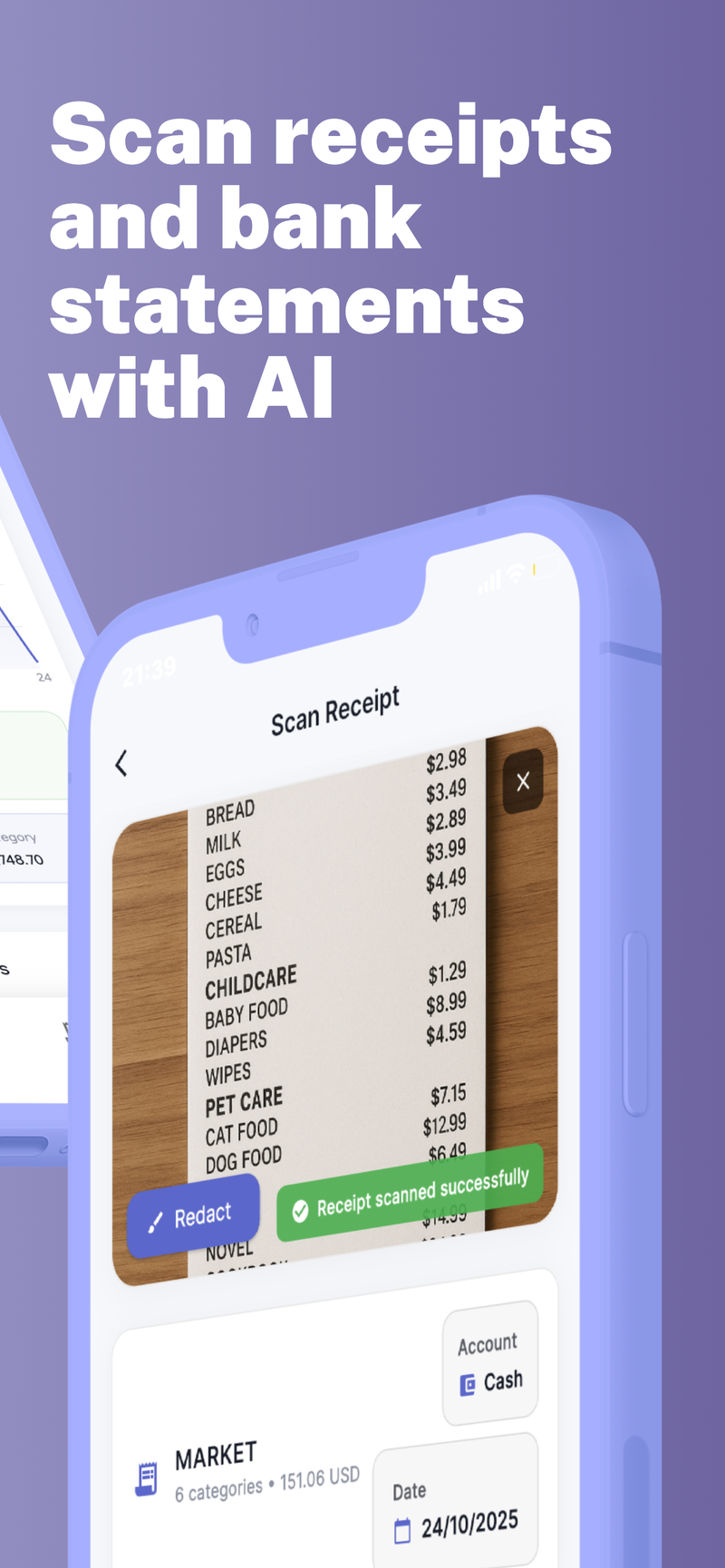

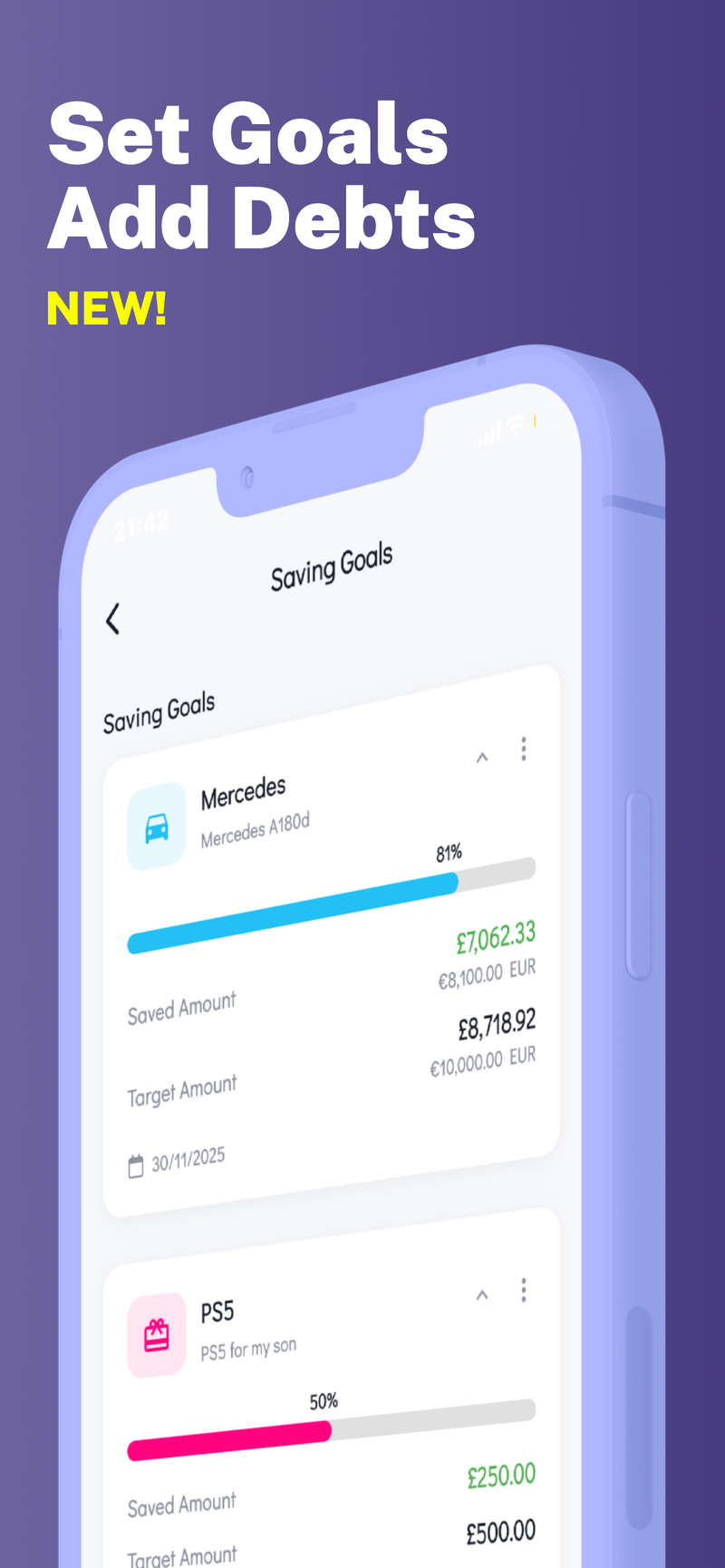

If you’re looking for a private, on-device budgeting tool to help manage multiple budgets side by side (for example, personal and family finances) in one place, Fokus Budget can help. Its Multi-Profile Support lets you track and adjust several budgets without cross-contamination of data, keeping your plans organized and your privacy intact.