Automate Your Family Budget Without Losing Control

Learn practical steps to automate your family budget without losing control. Build a simple money map, adopt a flexible budgeting framework, and deploy smart automations with regular check-ins. A subtle suggestion at the end points to a privacy focused tool that can help with this approach.

Introduction

Are you tired of watching your bank balance drift with the month, despite your best efforts? You want a budget that saves you time and reduces stress, not a rigid set of rules that feel hard to follow. The good news is you can automate meaningful parts of your family budget while still keeping a firm grasp on where your money goes. The key is to design a lightweight system that fits real life, not a perfect spreadsheet that collects dust.

Make automation work for your family budget

Automation works best when it reinforces a clear plan. It should take over repetitive tasks while leaving room for your hands on control when it matters most.

Start with a map of your money

A simple up front map makes automation effective and trustworthy:

Create a one page budget that reflects these categories and realistic monthly targets. This map is your benchmark for automated decisions.

Choose a flexible budgeting framework

Automation works best when you attach it to a framework you can adjust. Consider these common approaches:

Apply the framework to your net income and adjust every few months as family needs change. The goal is consistency, not perfection every month.

Automate routine money tasks thoughtfully

Automation should handle the boring parts and alert you when something looks off:

1) Automate fixed bills and savings: set automatic transfers for debt payments and savings on payday. This builds consistency and prevents missed allocations.

2) Create category rules: for example, if grocery spending hits a weekly threshold, trigger a quick alert or an automatic reallocation to a different category.

3) Schedule reminders for irregular costs: car insurance, property taxes, or annual memberships—these should land in your calendar so they don’t surprise you.

4) Build a healthy budget buffer: aim for a small surplus each month to cushion grocery price swings or fuel costs.

5) Keep a single source of truth: one place where you track actuals, targets, and adjustments helps everyone stay aligned.

Regular check-ins to stay aligned

Automation saves time, but it does not replace thoughtful oversight:

Real world scenarios

Common pitfalls and fixes

A practical 7 day plan

Conclusion

Automation can free up time and mental energy while keeping money under your informed control. The secret is pairing automation with a clear map of income, expenses, and goals, plus regular check-ins that catch drift early. When you automate, you still steer the ship rather than surrender control to a black box. Start with a simple money map, pick a flexible budgeting framework, set up smart automatic actions, and schedule small but regular reviews. With thoughtful setup, your family budget can glide toward your goals without feeling out of reach.

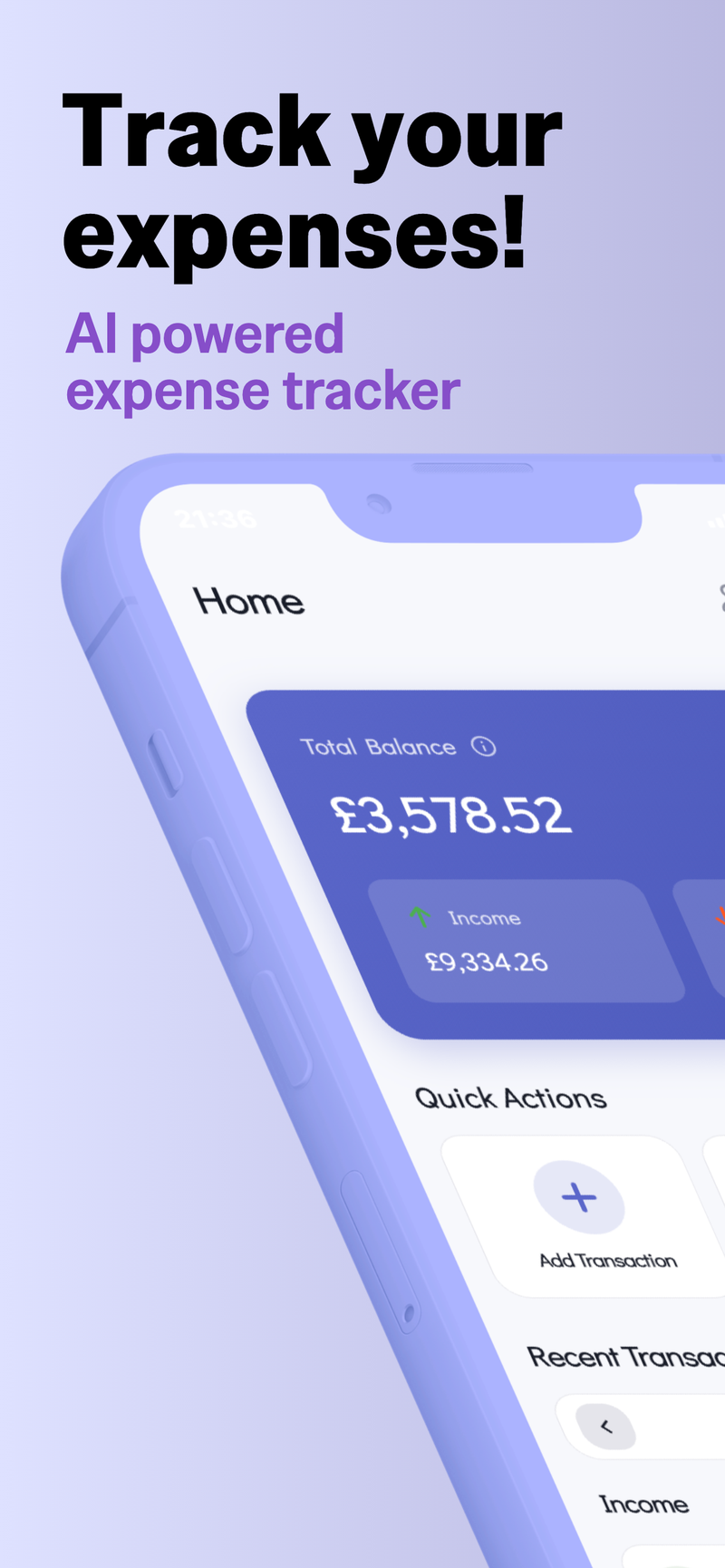

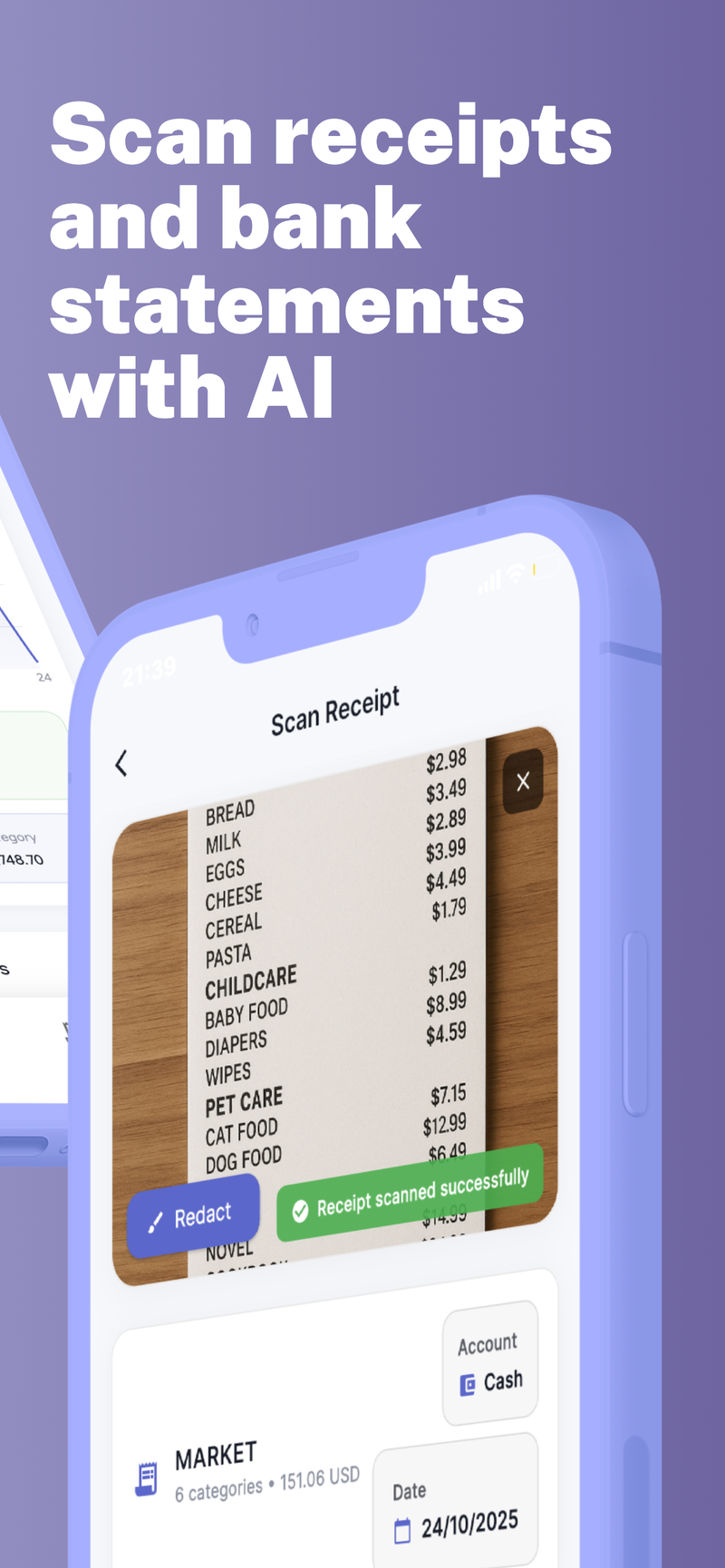

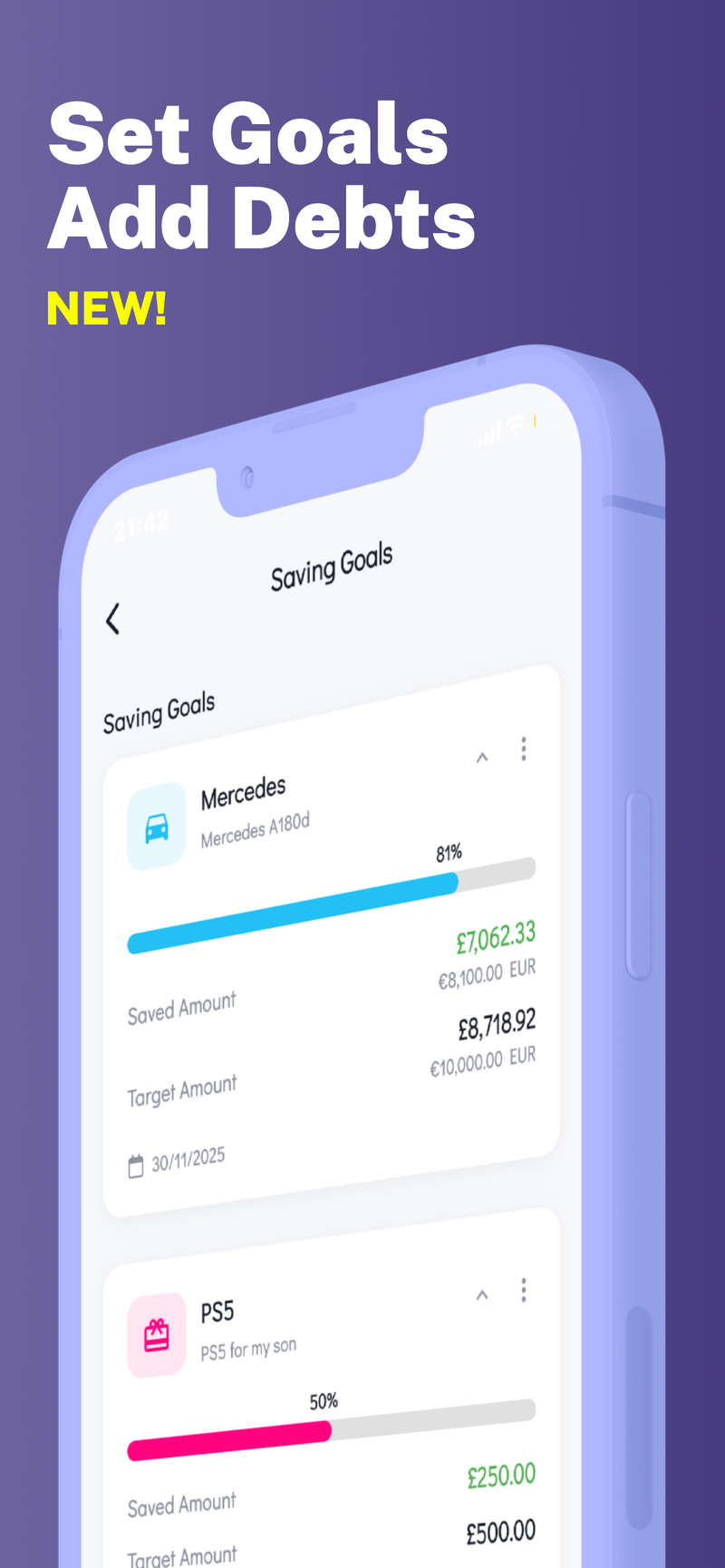

If you are looking for a tool that supports this approach with privacy in mind while helping you manage multiple family profiles, Fokus Budget offers a privacy first on-device data storage and supports multi-profile management to keep family finances organized in one place.

✨ Privacy-first on-device data storage