Introduction

If your paycheck arrives like a variable tide, you’re not alone. Irregular months can turn what you planned on the calendar into a scramble at the end of the month. The key isn’t perfection; it’s a budget that bends without breaking. This guide shares a practical framework you can apply with your family to keep essentials covered, build resilience, and still save for the future.

Main Content

Assess Your Baseline Essentials

Start by listing non-negotiables: housing (rent or mortgage), utilities, groceries, transportation, healthcare, insurance, and minimum debt obligations.Add a small, predictable buffer for each category (for example, an extra $20-$50 per month for groceries if prices rise).Calculate your “essential” monthly total by assuming a lean, realistic month. If rent is $1,400, utilities $260, groceries $550, transport $180, and insurance $350, your essential baseline might be about $2,740.Any money left after essentials should first target debt repayment and emergency savings before discretionary spending.Build a Buffer Against Irregular Months

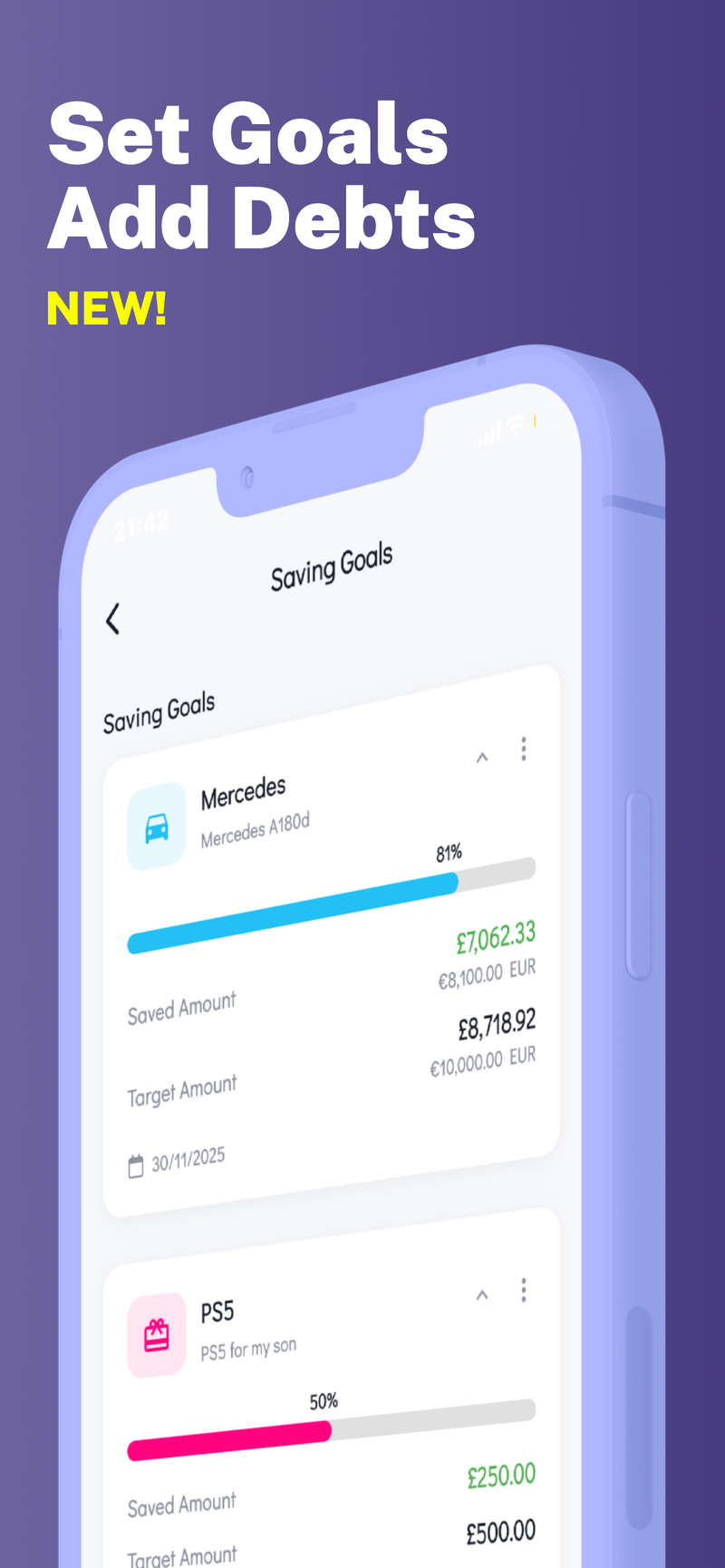

Goal: 3–6 months of essential expenses in an emergency fund. Using the $2,740 baseline, that means $8,220 to $16,440. Start with a achievable target (e.g., $1,000) and gradually grow toward the full range.Create a separate savings bucket for lean months. Automate small, regular transfers from a separate paycheck or savings account into this fund, so growth happens even on tough months.If you still have debt, prioritize minimum payments first, then add any surplus to the emergency fund.Reassess quarterly. If your expenses rise or fall, adjust the target range to keep pace with reality.Create a Flexible Monthly Plan

Use a two-bucket approach: Essential (must-have) and Flexible (nice-to-have).In a typical month, allocate funds to both buckets, with a clear cap on flexible spending.In lean months, pause discretionary spending first (dining out, entertainment, nonessential shopping). If needed, reduce groceries to a sustainable level while avoiding real deprivation (plan meals, buy in bulk, use leftovers).In strong months, funnel surplus to: (1) bolster the emergency fund, (2) pay down high-interest debt, (3) save for future goals (education, home projects, vacations).Establish priority rules: if income falls below essential expenses, don’t borrow from savings—adjust your monthly plan and delay nonessential purchases until the next month.Rolling Forecast and Family Involvement

Build a 3-month forecast that considers best-case, typical, and worst-case scenarios. For each scenario, outline how you’ll cover essentials, what discretionary draws are allowed, and where surplus should go.Hold a short family check-in once a month (15 minutes): review actuals vs forecast, adjust expectations, and celebrate progress.Use a simple spreadsheet or notebook to capture income, essential expenses, flexible spending, and savings. A shared plan reduces misunderstandings and keeps everyone aligned.Practical Tools for a Practical System

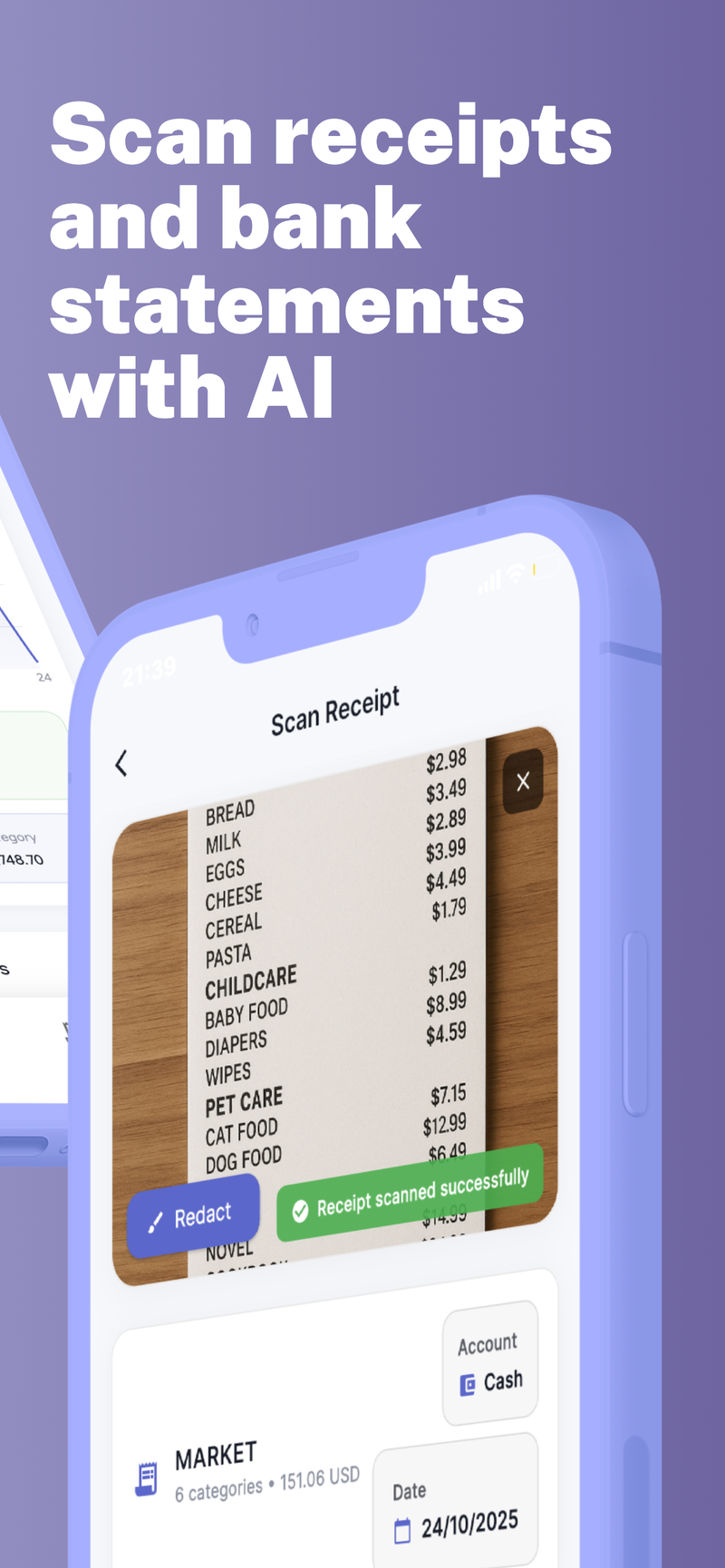

Track essentials and flexible categories separately.Use a basic envelope approach for discretionary funds during lean months (cash or virtual envelopes for dining out, entertainment, and shopping).Review weekly: 10 minutes to log expenses, adjust the next week’s plan, and catch drift before it becomes a problem.Keep a continual culture of savings: even small monthly gains matter when months are irregular.Real-Life Scenario (Numbers)

Baseline essentials: $2,740.Flexible monthly budget (non-essentials): $900 on average.Emergency fund goal: 3–6 months of essentials.Lean month example: income drops to $2,900. Allocate $2,740 to essentials, cut flexible spending to $160, and defer any nonessential plans. If income rises to $4,000 in a good month, put $400 toward emergency savings and $200 toward debt, with the rest going to discretionary spending or a larger goal.Strong month example: income $5,000. After essentials, add $1,260 to savings, $500 to debt, and use the remaining for discretionary needs and family experiences. The key is having a plan for both lean and strong months so you don’t rely on luck.Conclusion

Building a family budget that survives irregular months is about discipline with flexibility. Start by identifying essentials, create a real emergency buffer, and implement a two-bucket system that prioritizes needs first and lets you save during good months. Then bring the family into the loop with a simple forecast and a quick monthly check-in. With steady practice, you’ll soften the impact of unpredictable income and preserve peace of mind for your whole household.

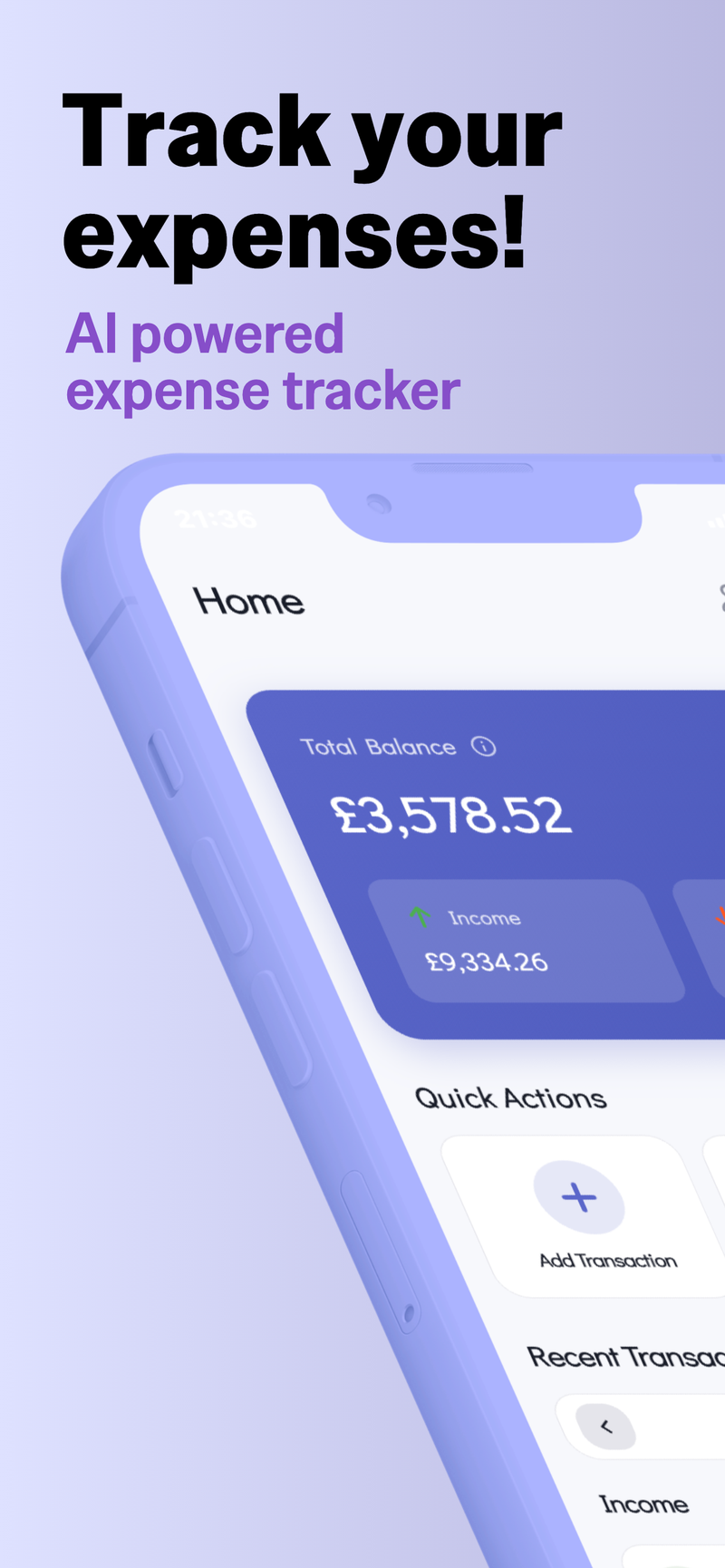

If you’re looking for a private, on-device solution to track multiple family profiles and currencies as you implement these strategies, Fokus Budget can help with on-device security and a clean, multi-profile workflow.