Introduction

Is your family budget always in flux, leaving you scrambling before payday? The 60/30/10 rule offers a simple, teachable framework: allocate 60% of take-home pay to essentials, 30% to lifestyle choices, and 10% to savings or debt payoff. It isn’t a strict cage—it's a flexible target you adjust as your family grows or encounters surprises.

How the 60/30/10 rule works in real life

Step-by-step implementation

Step 1: Calculate take-home pay. Take-home pay is your net income after taxes and other payroll deductions. If both partners contribute, combine incomes.Step 2: List fixed essentials. Think housing, utilities, groceries, transportation, insurance, healthcare, and childcare or school costs.Step 3: Allocate 60% to essentials. This is the front line where your most important costs live.Step 4: Allocate 30% to lifestyle. This covers dining out, entertainment, vacations, clothes, hobbies, and other discretionary spending.Step 5: Allocate 10% to savings or debt payoff. This includes an emergency fund, retirement contributions, and any extra debt payments.Example: a family with a monthly net income of $6,000 could allocate as follows:

Essentials (60%): $3,600Housing: $1,800Utilities: $250Groceries: $900Transportation: $350Insurance: $150Childcare/School costs: $150Lifestyle (30%): $1,800Dining out: $350Entertainment: $250Vacations fund: $200Shopping for clothes/gifts: $300Kids activities: $150Gym/fitness: $150Miscellaneous: $400Savings and debt payoff (10%): $600Emergency fund: $300Retirement: $200Extra debt payoff: $100Adjusting for family realities

60/30/10 is a guideline, not a rigid rule. If shelter costs are very high, you may need to push essentials toward 50–60% and adjust lifestyle or savings accordingly. Practical strategies include:

Cut discretionary items first in the lifestyle slice (dining out, streaming services, impulse shopping).Negotiate or shop around for essential costs (refinance a mortgage, compare insurance, bundle services).Use a sinking fund for known upcoming costs (back-to-school supplies, car maintenance, annual subscriptions).Irregular income and buffers

Many families deal with irregular pay. Try this approach:

Base your budget on the lowest predictable income for the month and build a buffer for lean months.Create 3–6 month cushion in savings to cover gaps when income dips.Establish sinking funds for annual or irregular costs (insurance premiums, holidays, car tags).Automate part of savings so automatic transfers happen before discretionary spending.Practical tips to make it stick

Track actuals for 1–2 months before adjusting the percentages; use a simple spreadsheet or budget template.Keep the plan visible in a shared space and review it during a family budget meeting.Involve kids with age-appropriate tasks like tracking allowances or helping compare prices.Round numbers help simplify decisions and reduce friction.Build in a monthly or quarterly review to reallocate as needed when circumstances change.Common mistakes to avoid

Treating 60/30/10 as a hard mandate every single month. Allow flexibility when life changes.Omitting irregular expenses or sinking funds from the plan.Neglecting to review and adjust after a few months.Failing to build an emergency fund or to contribute to long-term savings.Tools and habits to support 60/30/10

Use a simple budgeting template or spreadsheet to track categories and progress.Set up sinking funds for known annual costs (insurance, property taxes, gifts).Automate transfers to savings and debt payoff to reduce the chance of overspending.Keep receipts and categorize expenses promptly to maintain accuracy.Conclusion

Starting with the 60/30/10 rule gives families a clear, flexible path to balance needs, wants, and savings. With time, you’ll refine the allocations to fit your reality as income and obligations change, turning budgeting from a daily struggle into a straightforward habit.

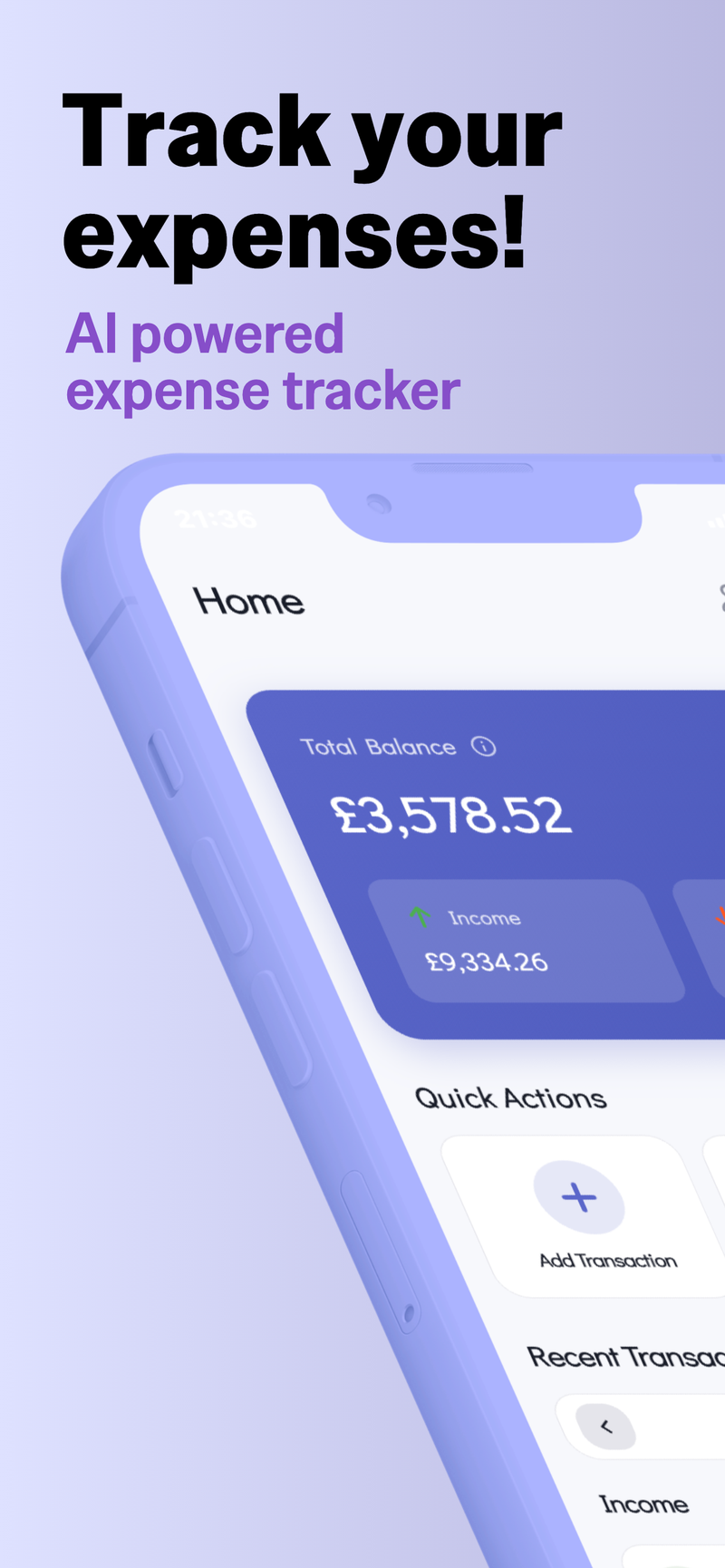

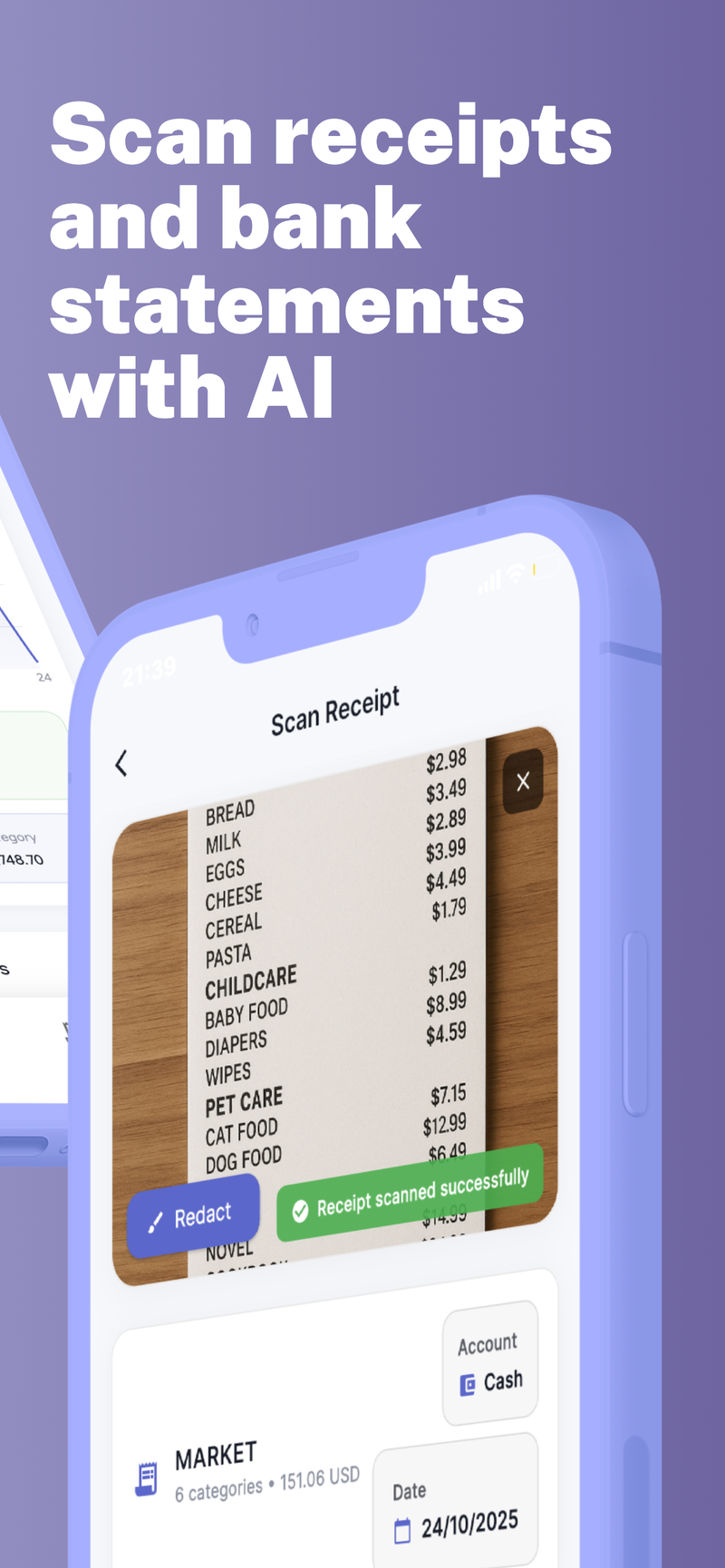

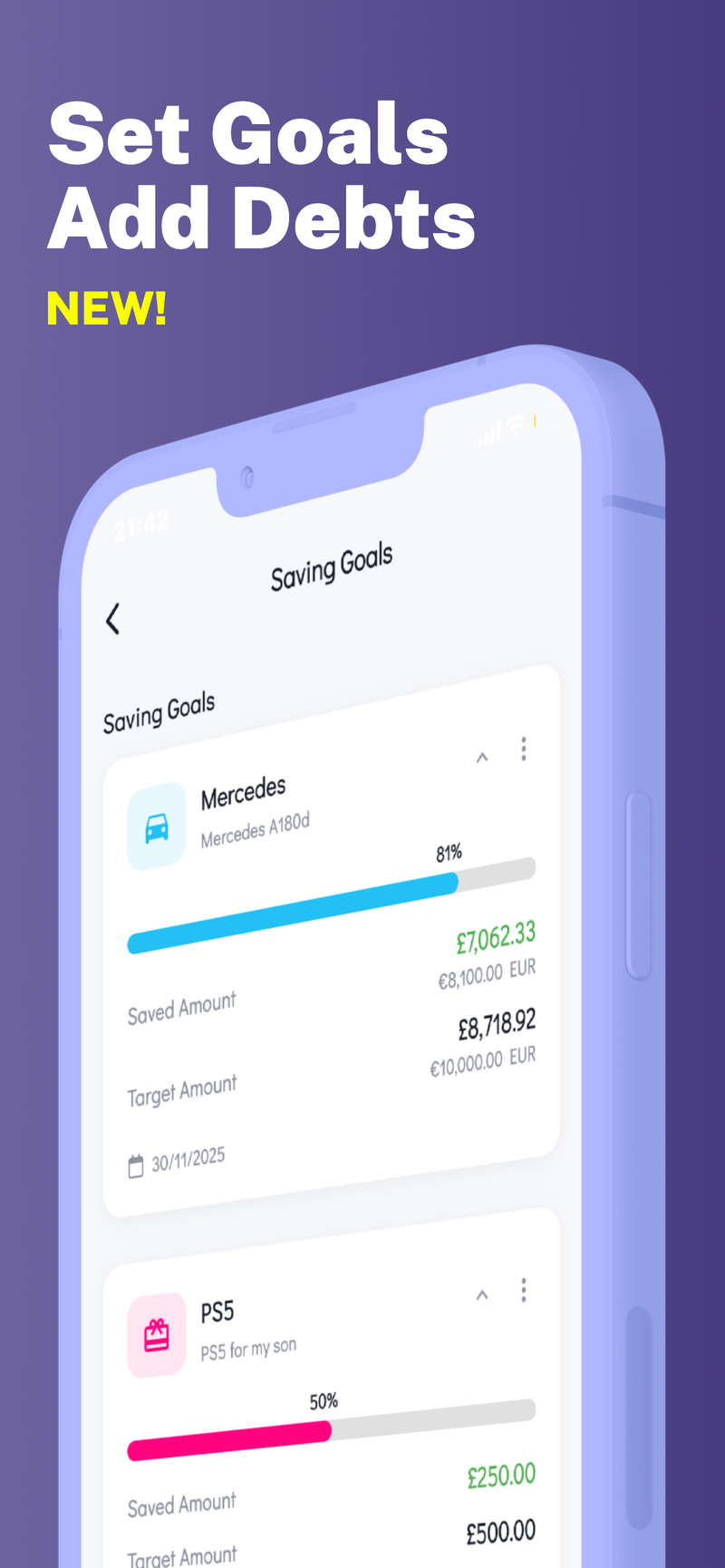

If you want a tool to help implement this smoothly while keeping data private, Fokus Budget can help. Its multi-profile support makes it easy to manage budgets for multiple family members, while keeping your information on your device. A practical, privacy-first approach can make sticking with the plan much simpler for everyone in the family.