15-Minute Weekly Budget Review: Cut Waste and Save Money

A practical, 15-minute weekly budget review you can start today. Learn a simple framework to spot waste, adjust your plan, and save more—without complexity.

15-Minute Weekly Budget Review: Cut Waste and Save Money

Introduction

If you’ve ever felt like your money slips away between paydays, you’re not imagining it. Small, unnoticed leaks—coffee buys, impulse online orders, recurring charges you forgot about—add up faster than you think. The good news is you don’t need hours to regain control. A focused 15-minute weekly review can bring clarity, surface waste, and set you up for steady saving.

The goal isn’t perfection; it’s consistency. A short, regular check-in helps you adjust before the month runs away. Think of it as a weekly tune-up for your finances—fast, practical, and repeatable.

Main content

The 15-Minute Framework for a Weekly Budget Review

This quick routine is designed to be finished in about 15 minutes. You can do it on Sunday afternoon, Monday morning, or any consistent moment that works for you.

Step 1: Gather and glance (5 minutes)

Tip: Don’t chase every small item. The goal is to spot patterns, not micromanage every cent.

Step 2: Compare to your plan (3–4 minutes)

Example: If your weekly grocery target is $120 and you spent $150, that’s +$30 variance you’ll want to address before week’s end.

Step 3: Identify waste and patterns (2–3 minutes)

Spot common drains that tend to creep in:

Quick audit questions:

Step 4: Decide actions and adjustments (2–3 minutes)

Choose 2–3 concrete actions to implement in the coming week. Examples:

If you’re over in a category, rebalance for the next week (e.g., reduce dining out by $15–$20).

Step 5: quick wrap-up and commit (1 minute)

Pro tip: Keep a small “discretionary buffer” each week for small wins. If you stay under budget elsewhere, reward yourself with a tiny treat instead of letting it slip away.

Practical tips to maximize the impact

Data-based insight: Regular tracking improves budgeting discipline. Even when the numbers aren’t perfect, the habit of weekly checks makes you more aware of where money goes and why it matters.

A ready-to-use 15-minute checklist

Common waste to watch for

Adopting this routine won’t require costly tools or complicated spreadsheets. A simple notebook, a one-page template, or a basic spreadsheet can keep everything visible and actionable. The key is consistency and a clear path from observation to action.

Conclusion

A 15-minute weekly budget review is a lean, repeatable method to cut waste and build savings without drama. By quickly gathering, comparing, and choosing a couple of targeted actions each week, you can strengthen your financial footing over time.

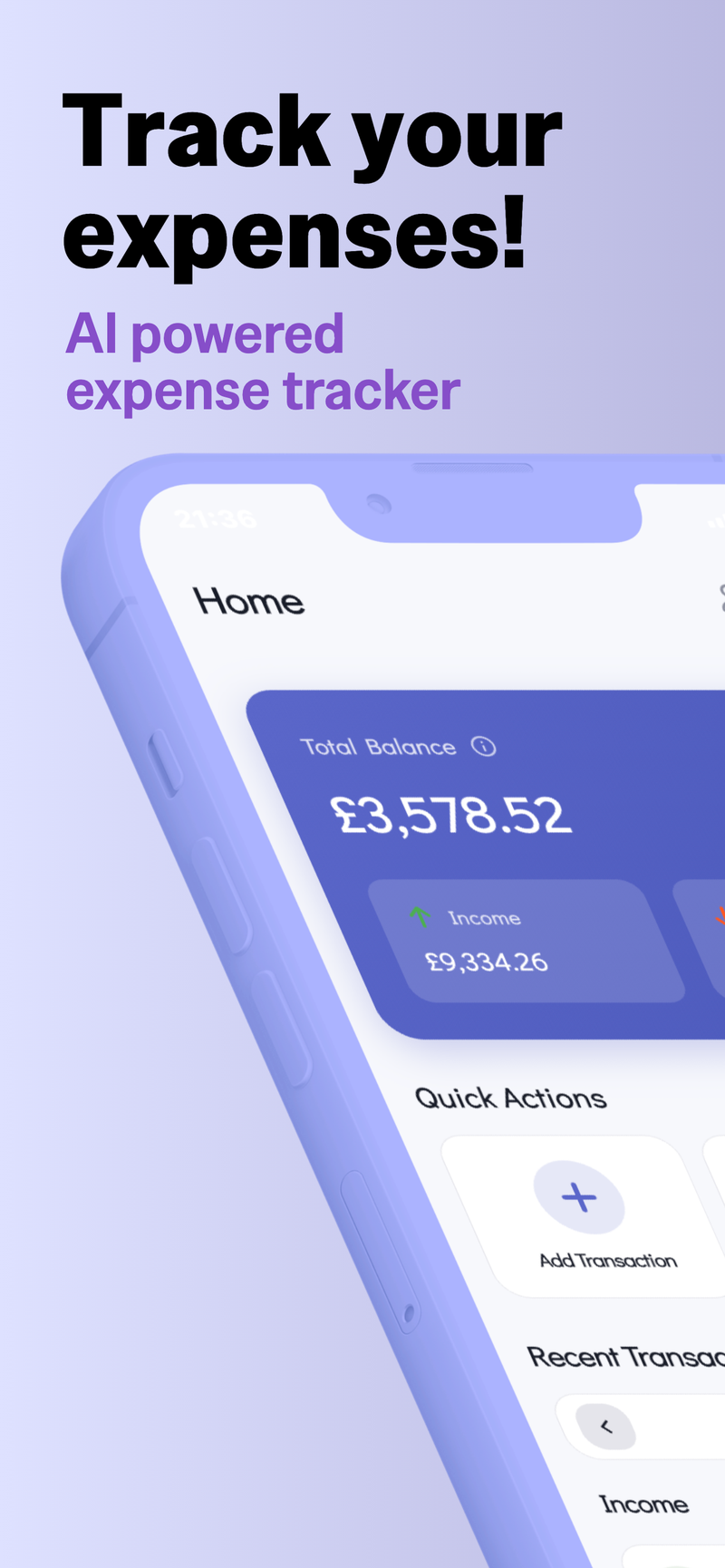

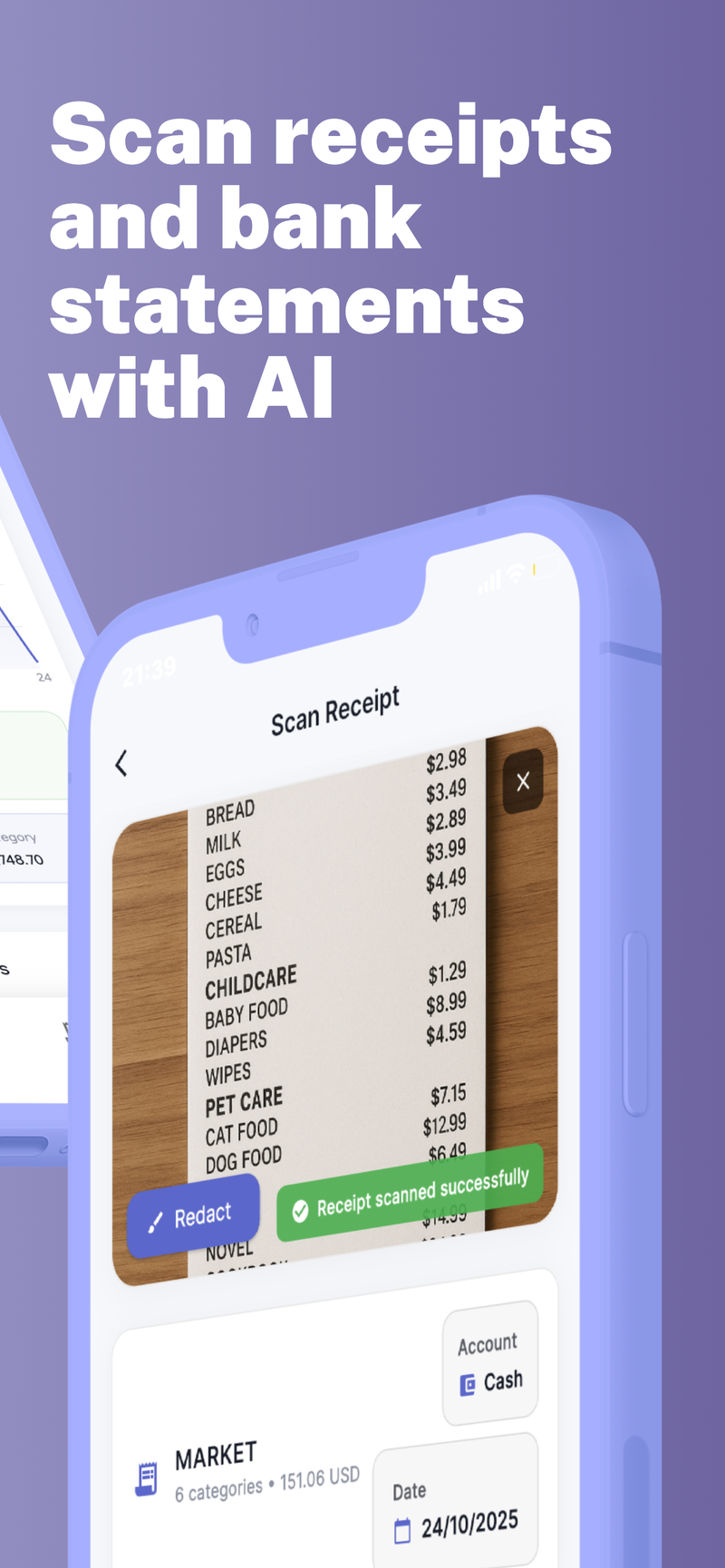

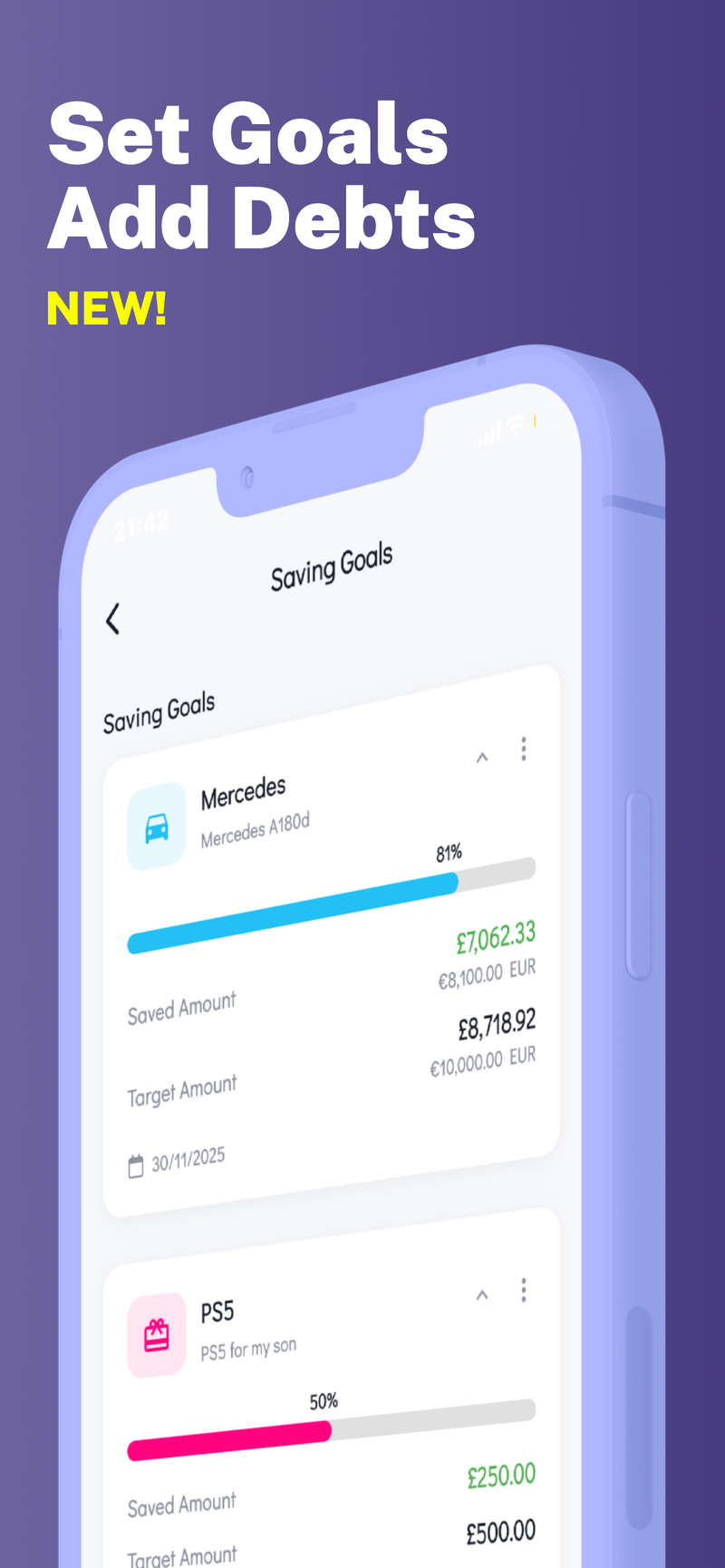

If you’re looking for a privacy-first budgeting tool to support this routine, Fokus Budget can help with a focused, secure approach to managing money. Fokus AI emphasizes on-device data storage and multiple profiles so you can keep personal, family, or business finances organized and private while you review and adjust your plan each week.

Promoted feature: Privacy-focused on-device data storage

✨ Privacy-focused on-device data storage