10 Practical Ways to Lower Household Bills This Year

Rising bills strain budgets, but practical, steady changes can add up. This guide offers 10 actionable steps—from energy habits to subscription audits—to help households cut costs this year.

Introduction

Are your monthly bills creeping up despite careful budgeting? If you’re like many families, you feel the pinch from energy costs, subscriptions, and groceries. The good news is that small, concrete changes can add up to meaningful savings without sacrificing comfort. Here are 10 practical ways to lower household bills this year.

1. Do a 30-day spending audit

Quick data point: tracking your spending can reduce impulse purchases by 10-15% over a few months.

2. Cut energy use with smart choices

Tip: even small changes like keeping the fridge at 3-5°C can save energy.

3. Review contracts and renegotiate

Data point: many households save 10-20% by shopping around and renegotiating.

4. Optimize heating and cooling habits

A well-maintained system can cut heating bills by 10-15% on average.

5. Review utility rates and billing plans

Savings vary, but informed rate choices can shave 5-15% off a yearly bill.

6. Reduce water waste and heating costs

A few fixes can substantially lower both water and energy use.

7. Plan meals and cut grocery waste

Tip: meal planning can reduce grocery bills by 10-15% on average.

8. Eliminate duplicate subscriptions

Estimated drain: many households pay for 3-4 services they barely use.

9. Rethink transportation costs

Smart driving can improve fuel economy and translate into noticeable savings over a year.

10. DIY fixes and seasonal maintenance

Small investments in maintenance pay off with fewer emergencies.

Conclusion

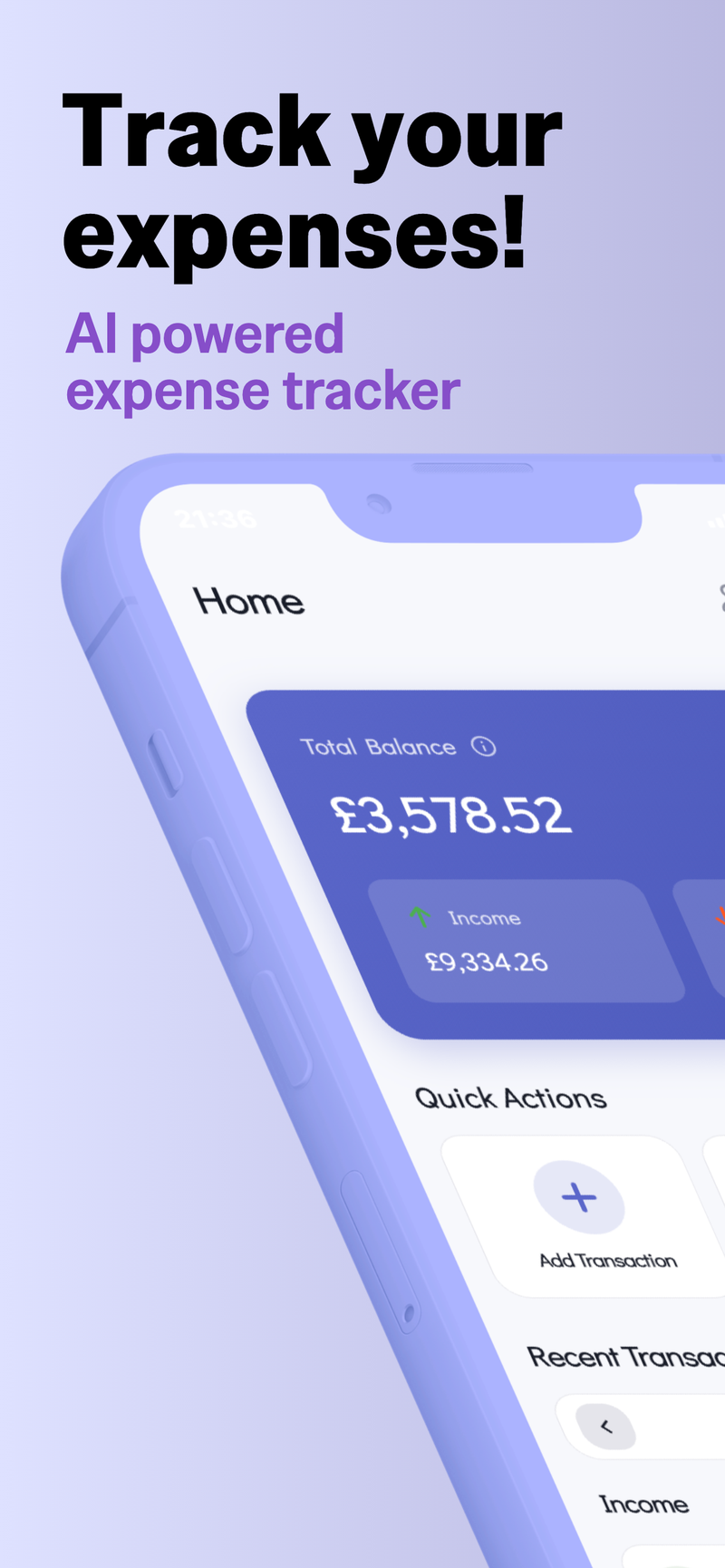

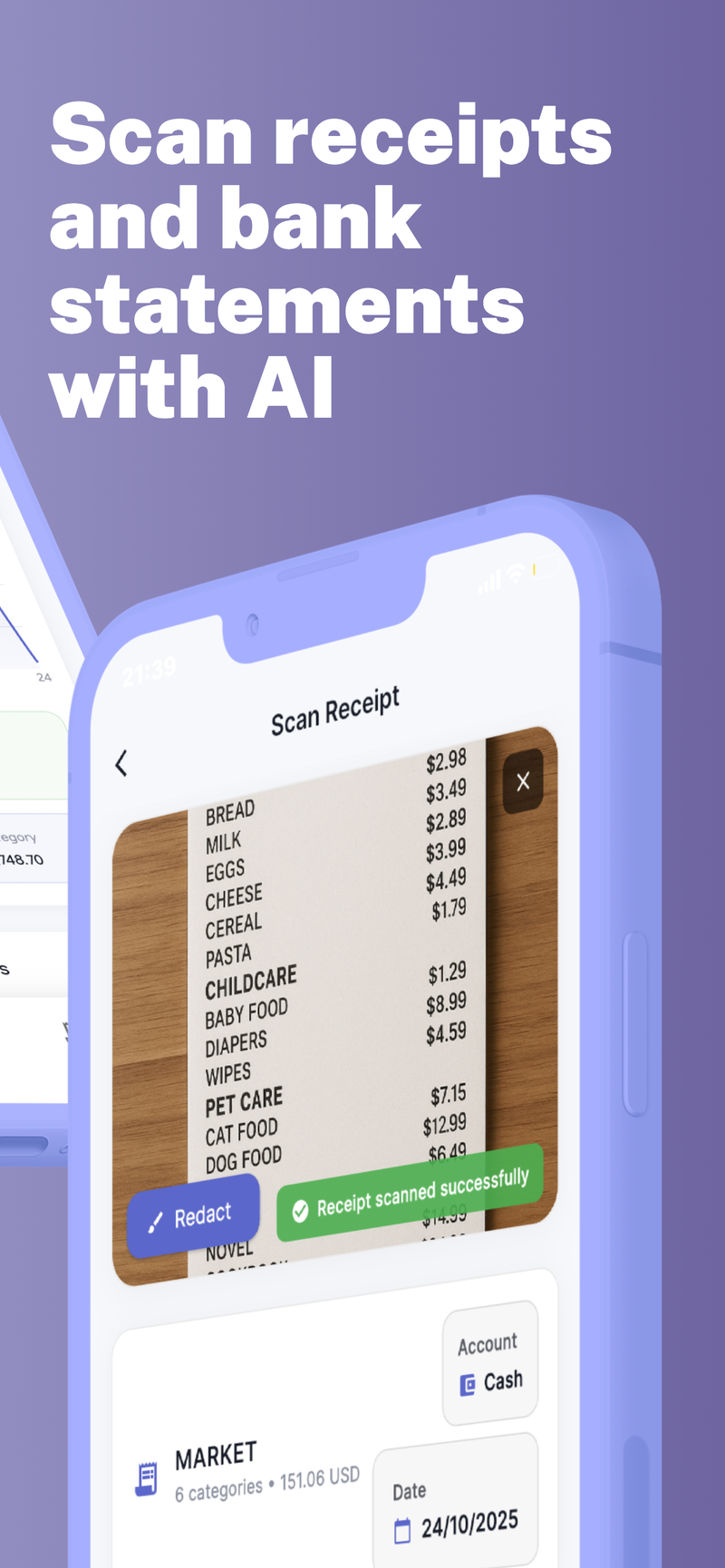

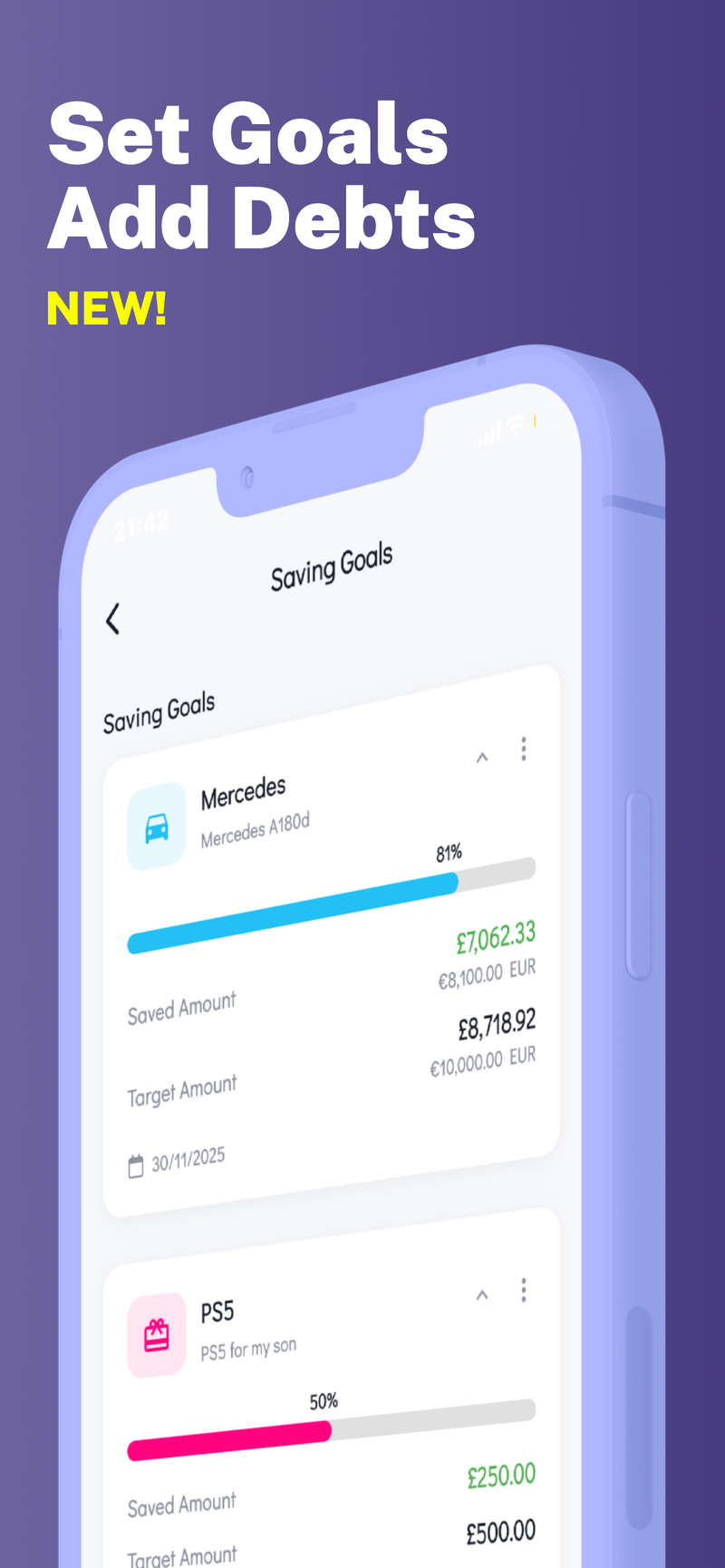

Saving money on household bills is less about big sacrifices and more about consistent, small decisions. Start with a quick audit, pick two tips to implement this month, and build from there. Track progress, celebrate small wins, and adjust as needed. If you want a private, easy way to organize your budget, track bills, and monitor progress across different areas, Fokus Budget can help. It offers a privacy-first approach with on-device data storage, so your financial information stays yours while you plan smarter.

✨ Privacy-first, on-device data storage